ICICI Demat Account Charges: Complete Details

If you’re thinking of opening a demat account with ICICI Securities, it’s essential to understand the various charges involved. In this comprehensive guide, we’ll walk you through the different charges associated with ICICI demat accounts charges, including account opening charges, annual maintenance charges, transaction charges, and other fees.

By selecting the right type of account that suits your investment needs and budget, you can save money and maximize your returns. Our expert insights will help you make an informed decision when opening an ICICI demat account. Keep reading to learn more about ICICI demat account charges and how to optimize your investment strategy.

Overview of ICICI Demat Account

ICICI Bank is one of the leading banks in India that offers Demat account services to its customers. A Demat account is a digital account that holds your securities like stocks, bonds, and mutual funds in an electronic format. The bank provides a hassle-free online Demat account opening process that takes only a few minutes.

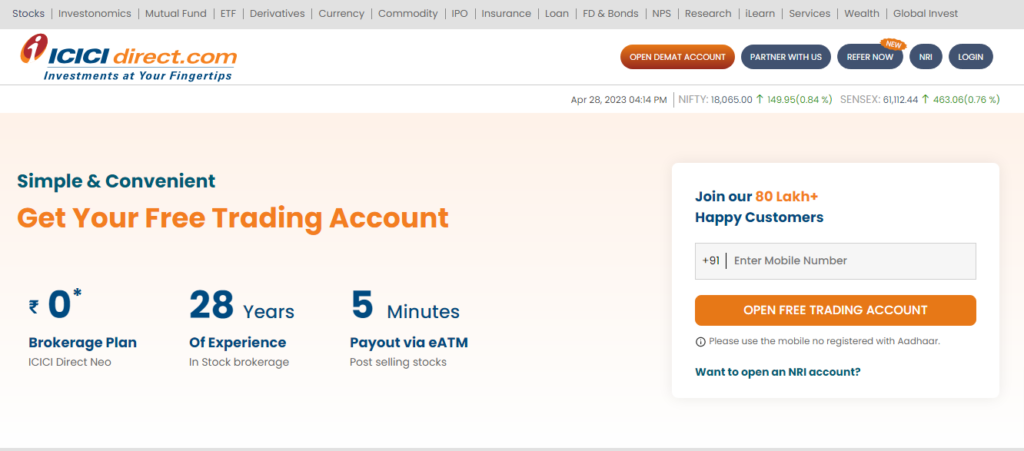

ICICI Direct

ICICI Direct is the online trading platform of ICICI Bank that offers a range of financial products and services to its customers. It is a one-stop-shop for all your investment needs and provides a convenient and secure way to manage your investments.

ICICI Direct offers a 3-in-1 account that includes a savings account, a trading account, and a Demat account. This account allows you to transfer funds between your savings account and trading account seamlessly and also provides a single login for all your investment needs.

ICICI Direct offers a range of Demat account types to suit the needs of different investors. The Basic Services Demat Account (BSDA) is a low-cost Demat account targeted at small investors with a very small portfolio of under Rs. 2 lakhs. SEBI had introduced BSDA to offer customers an alternative to high Demat costs. ICICI Direct also offers a regular Demat account for investors with a larger portfolio.

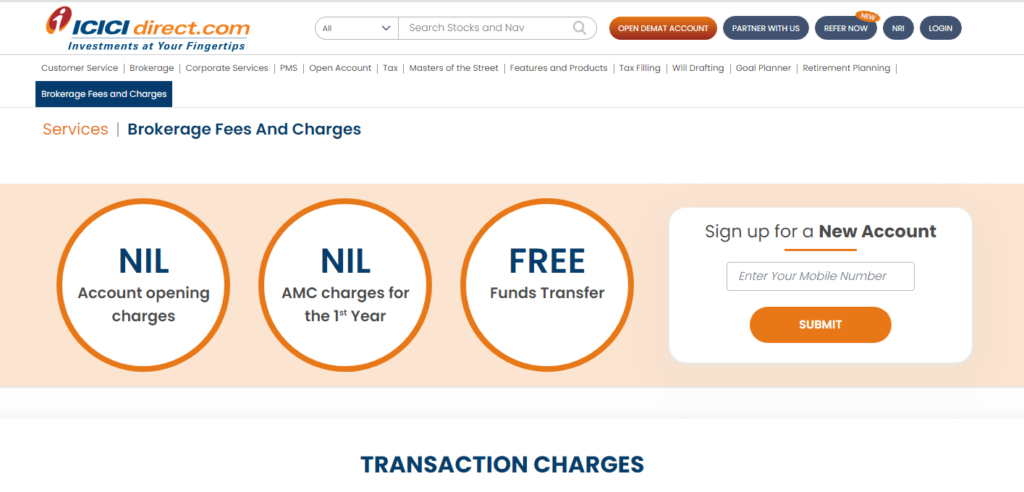

ICICI Demat account charges are competitive and transparent. There are no Demat account opening charges at ICICI Direct. However, customers are required to pay an annual maintenance charge (AMC) for their Demat account. The AMC for a regular Demat account is Rs. 300 per year.

In conclusion, ICICI Demat account is a reliable and convenient way to hold your securities in an electronic format. With ICICI Direct, you can manage your investments seamlessly and enjoy a range of financial products and services.

Charges Involved

Opening a Demat account with ICICI Bank involves various charges, including Account Opening Charges, Annual Maintenance Charges, Brokerage Charges, Transaction Charges, GST and Stamp Duty, and Other Charges.

Account Opening Charges

To open a Demat account with ICICI Bank, customers need to pay an account opening charge. The charges vary depending on whether the customer is a retail or corporate investor. According to ICICIdirect, there are no Demat account opening charges for retail customers.

Annual Maintenance Charges

ICICI Bank charges an Annual Maintenance Charge (AMC) for maintaining a Demat account. The AMC is levied on a yearly basis and is deducted from the customer’s bank account linked to the Demat account. The charges for AMC are different for retail and corporate investors. As per ICICI Bank’s website, the AMC for retail investors is Rs. 300 per year.

Brokerage Charges

ICICI Bank charges brokerage fees for buying and selling securities. The brokerage fee depends on the type of security and the transaction value. The minimum brokerage fee for transactions on stocks quoting more than 0.55% of the trade value for Equity delivery. The brokerage charge for Intraday trading, futures, and Options trading, and a commodity charge a flat fee of Rs. 20 per trade. For more information on brokerage fees, visit ICICIdirect.

Transaction Charges

ICICI Bank charges transaction fees for debiting and crediting securities from the Demat account. The transaction charges depend on the value of the securities transferred. As per ICICIdirect, the transaction charges for delivery-based equity transactions are 0.04% of the transaction value, subject to a minimum of Rs. 25 and a maximum of Rs. 50 per transaction.

GST and Stamp Duty

ICICI Bank charges GST and Stamp Duty on the brokerage fees and transaction charges. The GST is charged at 18% of the brokerage fees and transaction charges, while the Stamp Duty is charged as per the state’s regulations.

Other Charges

Apart from the above charges, ICICI Bank may levy other charges such as charges for delivery instruction slips, pledge creation, and closure of Demat account. Customers are advised to check with the bank for the latest charges.

In conclusion, opening and maintaining a Demat account with ICICI Bank involves various charges. Customers are advised to check the latest charges before opening a Demat account and keep track of the charges to avoid any surprises.

Account Opening Process

Opening an ICICI Demat account is a straightforward process that can be done either online or in-person at the nearest ICICI Bank branch. The account opening process requires customers to submit certain documents and pay fees as per the ICICI Demat account charges.

Online Account Opening

Opening an ICICI Demat account online is a convenient and hassle-free option. Customers can visit the ICICI Direct website and fill out the online application form. Once the form is submitted, the customer will receive a call from an ICICI representative who will guide them through the rest of the process.

Documents Required

To open an ICICI Demat account, customers will need to submit the following Documents:

- Identity proof: PAN card, Aadhaar card, passport, voter ID, or driving license

- Address proof: Aadhaar card, passport, voter ID, driving license, or utility bills

- Passport-sized photographs

- Bank account details

ICICI Bank also offers a 3-in-1 account, which combines a savings account, trading account, and Demat account in one. To open a 3-in-1 account, customers will need to submit additional documents such as income proof, proof of occupation, and tax returns.

It is important to note that the documents required may vary depending on the type of account being opened and the customer’s nationality and residency status.

Overall, the account opening process for ICICI Demat accounts is a simple and straightforward process that can be done either online or in-person. By following the guidelines and submitting the required documents, customers can easily open an ICICI Demat account and start trading in the Indian stock market.

Conclusion

To sum up, opening an ICICI Direct Demat Account can be a good choice for investors who want to manage their securities electronically. However, it is important to understand the charges and fees associated with the account before making a decision. The Demat account opening charge, annual maintenance charge, and transaction charges are some of the fees to consider. ICICI Direct does not charge any Demat account opening fees, but there is an annual maintenance charge of Rs. 300 and a transaction charge of Rs. 25 per transaction. Additionally, there may be charges for other services such as pledge creation, dematerialization, and rematerialization. By reviewing the fee structure and terms and conditions, you can decide whether an ICICI Direct Demat Account is right for you.

FAQ ICICI Demat Account Charges

What are the demat account maintenance charges for ICICI Bank?

ICICI Bank levies an annual maintenance charge (AMC) of Rs. 300 on its demat account holders. The AMC is applicable from the second year of account opening and is charged annually.

How can I pay my ICICI demat account bill online?

ICICI Bank provides its customers with the option to pay their demat account bills online through its internet banking portal or mobile banking app. Customers can also set up automatic payments for their demat account bills.

What are the charges for opening an ICICI demat account?

ICICI Bank does not charge any fees for opening a demat account. However, customers may have to pay a one-time account opening charge to the depository participant (DP) who opens the account on behalf of ICICI Bank.

How can I avoid DP charges in ICICI Bank?

ICICI Bank charges its customers for various DP services such as dematerialization, rematerialization, and pledge creation. To avoid these charges, customers can opt for a Basic Services Demat Account (BSDA) which is a no-frills demat account with reduced charges.

What is the minimum balance required for a demat account in ICICI Bank?

ICICI Bank does not require its customers to maintain a minimum balance in their demat accounts. However, customers must maintain sufficient balance to cover the AMC and any other charges levied by the bank.

What are the brokerage charges for delivery in ICICI Direct?

ICICI Direct charges a brokerage fee of 0.55% on delivery trades. The brokerage fee is subject to a minimum charge of Rs. 25 per trade and a maximum charge of Rs. 3,000 per trade.