Kotak Demat Account Charges: A Comprehensive Overview

Opening a demat account with Kotak Securities can be a wise investment decision, but it’s crucial to understand the various charges involved. This comprehensive guide walks you through the different charges associated with Kotak demat accounts, including account opening charges, annual maintenance charges, transaction charges, and other fees.

By selecting the right type of account that suits your investment needs and budget, you can save money and maximize your returns. Our expert insights will help you make an informed decision when opening a Kotak demat account. Keep reading to learn more about Kotak demat account charges and how to optimize your investment strategy.

Overview of Kotak Demat Account

Kotak Mahindra Bank offers a Demat account service through its subsidiary Kotak Securities. A demat account is an electronic account that holds your securities in a digital format. It eliminates the need for physical certificates and enables easy and secure trading of shares.

Kotak Securities demat account is a convenient and hassle-free way to hold your securities. It is a safe and secure way to store your investments, as it reduces the risk of loss, theft, or damage of physical certificates. Moreover, it provides easy access to your holdings, enabling you to track your investments and make informed decisions.

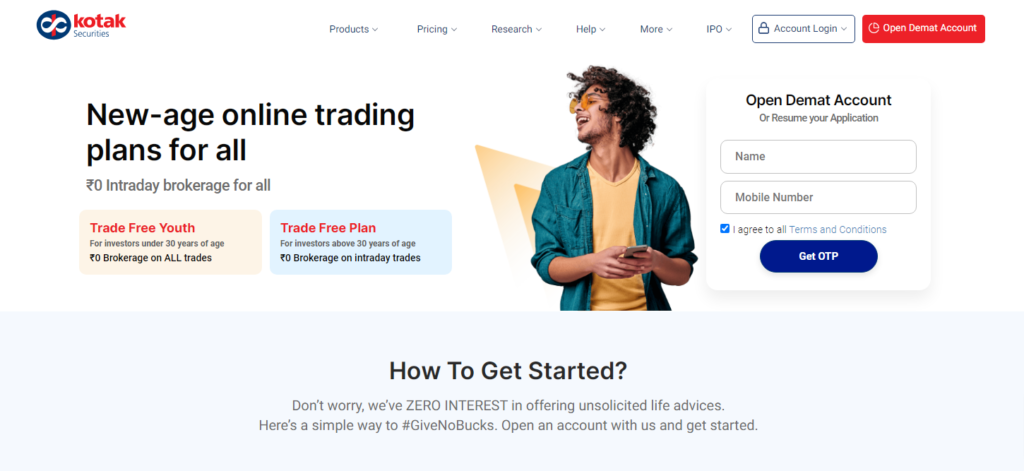

The demat account can be opened online, and the account opening process is simple and straightforward. Kotak Securities offers a range of demat account services, including account opening, maintenance, and transaction-related services.

Kotak Securities demat account charges are competitive and transparent. The charges include account opening charges, annual maintenance charges, transaction charges, and other charges as applicable. The schedule of charges is available on the Kotak Securities website and can be easily accessed.

Kotak Securities demat account is a reliable and trustworthy service that enables you to hold your securities in a safe and secure manner. It provides a range of services that cater to the diverse needs of investors. With Kotak Securities’ demat account, you can trade with confidence and make the most of your investments.

Account Opening Process

Opening a Kotak Demat account is a simple and straightforward process that can be completed online or offline. Here is a breakdown of the account opening process for residents and NRIs.

Resident Account Opening

To open a resident Kotak Demat account, the applicant needs to follow the steps below:

- Visit the Kotak Securities website and click on the ‘Open an Account’ option.

- Fill out the online form with personal details such as name, address, and contact information.

- Submit the necessary Documents, including a PAN card and proof of address, either online or by visiting the nearest Kotak Securities branch.

- Pay the account opening charges, which typically include brokerage charges, annual fees, and demat charges.

Once the application is processed and approved, the applicant will receive a welcome kit containing the account details and login credentials.

NRI Account Opening

To open a Kotak Demat account as an NRI, the applicant needs to follow the steps below:

- Visit the Kotak Securities website and click on the ‘Open an Account‘ option.

- Fill out the online form with personal details such as name, address, and contact information.

- Submit the necessary documents, including a PAN card, passport, and proof of address, either online or by visiting the nearest Kotak Securities branch.

- Pay the account opening charges, which typically include brokerage charges, annual fees, and demat charges.

The NRI account opening process may take longer than the resident account opening process due to additional compliance requirements.

It is important to note that Kotak Securities offers a 3-in-1 account that includes a trading account, bank account, and demat account. This integrated account allows for seamless trading and settlement of securities, making it a popular choice among investors.

Overall, the account opening process for the Kotak Demat account is straightforward and can be completed within a few days. Making it an attractive option for those looking to invest in the stock market.

Kotak Demat Account Charges and Fees

Kotak Mahindra Bank offers a range of tariff plans for its demat account services to cater to the needs of different categories of investors in the capital market. The general tariff plan is suitable for clients who do not transact too frequently. However, for frequent traders, Kotak Securities offers a special tariff plan that provides reduced brokerage charges, among other benefits.

Charges

The charges for using Kotak Securities’ demat account services. While there are no charges payable at the time of opening the account, other charges such as brokerage charges, annual maintenance charges, demat charges, stamp duty, transaction charges, securities transaction tax (STT), regulatory charges, and courier charges are applicable.

Brokerage Charges

Whenever a client buys or sells stocks, they have to pay a fee known as a brokerage charge. The charge can be a percentage of the transaction value, 0.39% for Equity delivery and 0.04% for Intraday Trading, and a flat fee of Rs. 20 for Futures and Options Trading and commodity.

Annual Maintenance Charges

Annual maintenance charges (AMC) are charged Rs. 50 per month. The AMC covers the cost of maintaining the demat account, including the cost of sending account statements and other communications.

Demat Charges

Demat charges are applicable for the conversion of Physical shares into electronic form and vice versa. The charges vary depending on the number of shares being converted and the tariff plan chosen by the client. Kotak Securities doesn’t charge for demat account opening.

Stamp Duty

Stamp duty is a tax levied by the government on the Transfer of shares from one person to another. The rate of stamp duty varies from state to state and is typically a percentage of the transaction value.

Transaction Charges

Transaction charges are levied by the depository on the movement of shares from the demat account. The charges vary depending on the number of shares being moved and the tariff plan chosen by the client.

Securities Transaction Tax (STT)

STT is a tax levied by the government on purchasing and selling securities. The rate of STT varies depending on the type of security being traded and the transaction value.

Regulatory Charge

Regulatory charges are levied by the depository on behalf of the Securities and Exchange Board of India (SEBI) for the purpose of regulating the securities market.

Courier Charges

Courier charges are applicable for the delivery of physical copies of account statements and other communications. The charges vary depending on the location of the client and the frequency of delivery.

Failed Transactions

In case of failed transactions, Kotak Securities may levy charges for the reprocessing of the transaction. The charges vary depending on the nature of the transaction and the tariff plan chosen by the client.

Overall, Kotak Securities’ demat account services offer a range of tariff plans to cater to the needs of different categories of investors in the capital market. The charges and fees associated with the demat account services are transparent and vary depending on the tariff plan chosen by the client.

Conclusion

Opening a Kotak Securities Demat Account can be a great way to invest in the stock market and manage your securities electronically. However, it is important to carefully review the charges and fees associated with the account before making a decision. The account opening fee, annual maintenance fee, and transaction fee are some of the charges that you should consider. Additionally, it is important to keep in mind that there may be charges for other services, such as pledge creation, dematerialization, and rematerialization. Understanding the fee structure and terms and conditions lets you decide whether a Kotak Securities Demat Account is right for you.

Frequently Asked Questions

What are the AMC charges for Kotak demat account?

The AMC charges for a Kotak demat account vary based on the value of holdings. For holdings up to ₹50,000, there will be no AMC charges. For holdings between ₹50,001 and ₹2,00,000, the AMC charges will be up to ₹100 per annum. For BSDA account holders, the AMC charges will be on a slab basis.

What are the charges for opening a Kotak demat account?

Kotak Securities offers free account opening for demat and trading accounts. However, there may be charges for account maintenance and other services.

What are the charges for a Kotak 3-in-1 account?

The charges for a Kotak 3-in-1 account, which includes a savings account, trading account, and demat account, may vary based on the services availed. Customers are advised to check with the bank for the latest charges.

What are the brokerage charges for Kotak securities?

Kotak Securities offers different brokerage plans based on the trading frequency and investment amount. The brokerage charges start from zero for intraday trading and go up to 0.49% for delivery-based trading. Customers are advised to check with the broker for the latest brokerage charges.

What is the minimum balance for a Kotak trinity account?

The minimum balance for a Kotak trinity account, which includes a savings account, trading account, and demat account, may vary based on the services availed. Customers are advised to check with the bank for the latest minimum balance requirements.

What are the DP charges for Kotak demat account?

The DP charges for a Kotak demat account may vary based on the type of transaction, such as buying or selling securities, and the value of the transaction. Customers are advised to check with the broker for the latest DP charges.