IIFL vs Angel One: Which Is Best For You?

In this post, I’m going to compare IIFL and Angel One.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare IIFL vs Angel One in terms of:

- Overview

- Trading Platform

- Account Opening and Maintenance charges

- Brokerage Charges

- Advantages and Disadvantages

Let’s get started.

Summary of IIFL vs Angel One

| IIFL | Angel One | |

|---|---|---|

| Type | Full-Service Broker | Full-Service Broker |

| Year Founded | 1995 | 1987 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 3.9 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.05% or Rs. 20 per executed order, whichever is lower | 0.03% or Rs 20 per order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs. 20 | Rs. 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 378 branches | More than 110 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | N/A |

| Ranking | 9th | 6th |

Overview of IIFL and Angel One

When it comes to choosing a stock broker in India, you have a lot of options to consider. Two of the most popular choices are IIFL and Angel One. Both IIFL and Angel One are registered with SEBI and offer investment opportunities in equity, F&O, currency, and commodities.

IIFL Securities is a full-service broker that has been around since 1995. It offers a range of services, including investment banking, wealth management, and research. IIFL Securities charges a brokerage fee of Rs 20 per order for equity and intraday trading.

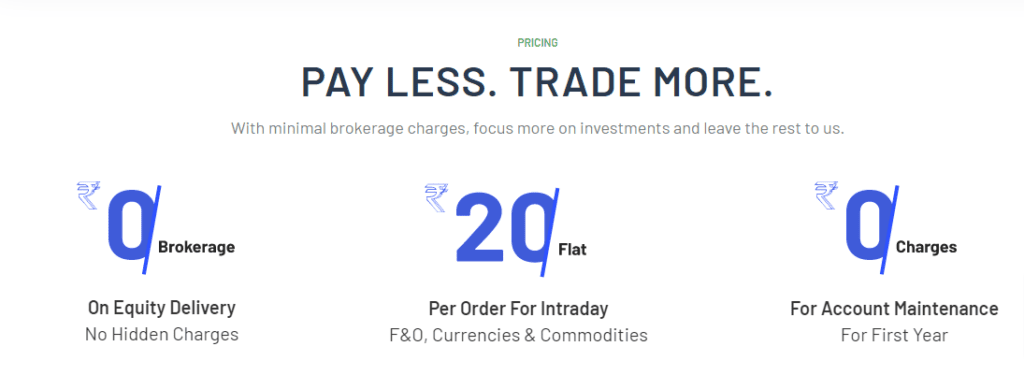

On the other hand, Angel One is a discount broker founded in 1987. It offers a variety of investment options and has a brokerage fee of Rs 20 per executed order for intraday trading. For equity trading, Angel One charges no brokerage fees.

Both IIFL and Angel One have their pros and cons. IIFL Securities is a full-service broker that offers a wide range of services, including research and investment banking. However, its brokerage fees are higher than Angel One’s. On the other hand, Angel One is a discount broker that charges lower brokerage fees. However, it doesn’t offer as many services as IIFL Securities.

The choice between IIFL Securities and Angel One depends on your investment needs. If you are looking for a full-service broker offering a wide range of services, IIFL Securities may be the better choice. If you are looking for a discount broker that charges lower brokerage fees, Angel One may be the better choice.

Services Offered

Both IIFL and Angel One offer a range of services to their clients. These include:

- Full-service brokerage services

- Online trading platforms

- Advisory services

- Investment options and products

Both brokers offer a range of investment options, including stocks, mutual funds, and IPOs. They also provide research reports and analysis to help you make informed investment decisions.

IIFL offers its clients a range of advisory services, including wealth management, portfolio management, and financial planning. They also have a dedicated team of experts who provide personalized investment advice to clients.

Angel One provides a variety of trading and investment services, including commodity trading, currency trading, and derivatives trading. They also offer a range of products, including insurance, loans, and credit cards.

When it comes to online trading platforms, both brokers offer user-friendly platforms that are easy to navigate. IIFL’s trading platform, IIFL Markets, is available as a mobile app and desktop platform. Angel One’s trading platform, Angel Broking, is also available as a mobile app and desktop platform.

Overall, both brokers offer a range of services to suit the needs of different types of investors. Whether you are a beginner or an experienced trader, both IIFL and Angel One have something to offer.

Trading Platforms

When it comes to trading platforms, both IIFL and Angel One offer a range of options to their clients. Let’s take a closer look at what each platform has to offer.

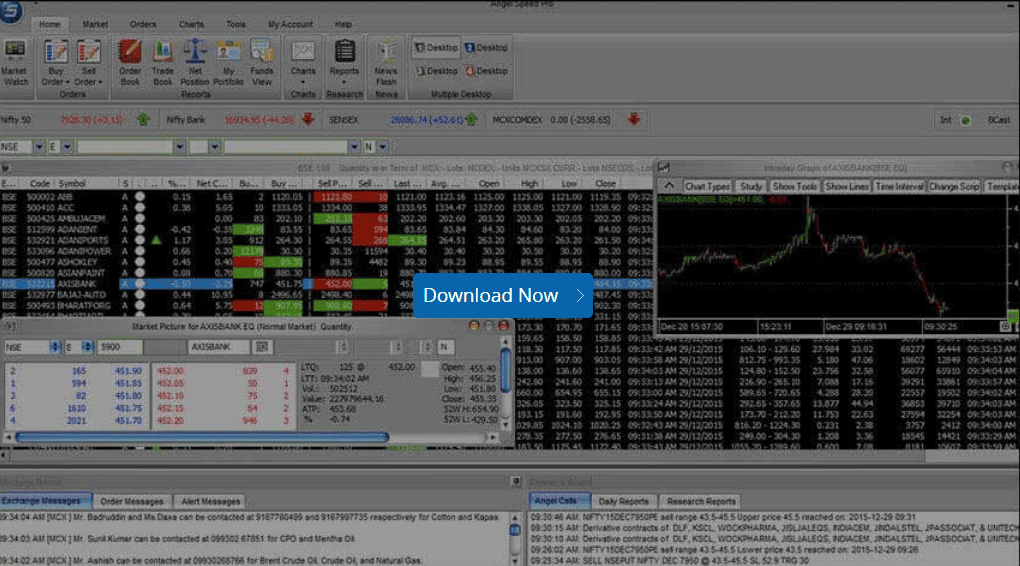

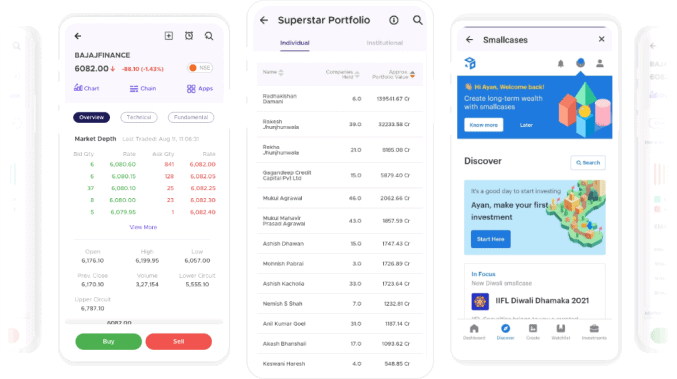

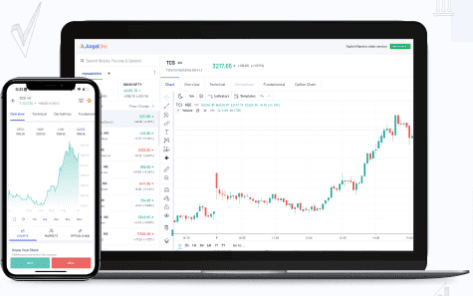

Angel SpeedPro

Angel One’s flagship trading platform, Angel SpeedPro, is a desktop-based trading software that offers a range of features to traders. The platform is available for Windows users and offers real-time streaming quotes, advanced charting tools, and customizable workspace. It also offers a range of order types, including bracket orders, cover orders, and trailing stop-loss orders.

IIFL Markets App

IIFL’s mobile app, IIFL Markets, is a feature-rich trading app that allows you to trade on the go. The app is available for both Android and iOS devices and offers a range of features, including real-time streaming quotes, advanced charting tools, and a customizable watchlist. The app also offers a range of order types, including bracket orders, cover orders, and trailing stop-loss orders.

Other Trading Platforms

In addition to their flagship trading platforms, both IIFL and Angel One offer other trading platforms to their clients. For example, Angel One offers Angel Broking App, a mobile trading app, and Angel Eye, a web-based trading platform. IIFL, on the other hand, offers a range of trading platforms, including IIFL Trader Terminal, a desktop-based trading software, and IIFL Markets Web, a web-based trading platform.

Overall, both IIFL and Angel One offer a range of trading platforms to their clients, catering to the needs of both desktop and mobile traders. Whether you prefer desktop-based trading software or a mobile trading app, both brokers have you covered.

Account Types and Opening Process

When it comes to account types, both IIFL and Angel One offer a range of options to choose from. These include Trading account, Demat account, and 3-in-1 accounts.

To help you compare the account opening and maintenance charges for both brokers, we’ve put together the following table:

| Broker | Trading Account Opening Charges | Demat Account Opening Charges | Trading Account Maintenance Charges | Demat Account Maintenance Charges |

|---|---|---|---|---|

| IIFL | Free | Free | Free | Free for the first year, then Rs. 250 per year |

| Angel One | Free | Free | Free | Rs. 240 per year |

As you can see, both brokers offer free trading account openings. However, Angel One charges Rs. 240 per year for demat account maintenance, while IIFL offers free demat account maintenance for the first year and then charges Rs. 250 per year.

Demat Account Opening

To open a Demat account with IIFL, you can visit their IIFL Website and fill out the online application form. You will need to provide your PAN card, Aadhaar card, and a cancelled cheque. Once your application is processed, an IIFL representative will get in touch with you to complete the account opening process.

To open a Demat account with Angel One, you can visit their Angel One Website and fill out the online application form. You will need to provide your PAN card, Aadhaar card, and a cancelled cheque. Once your application is processed, you will receive a welcome kit containing your account details and instructions on how to activate your account.

Trading Account Opening

To open a trading account with IIFL, you can visit their website and fill out the online application form. You will need to provide your Documents details. Once your application is processed, an IIFL representative will contact you to complete the account opening process.

To open a trading account with Angel One, you can visit their website and fill out the online application form. You will need to provide your PAN card, Aadhaar card, and a cancelled cheque. Once your application is processed, you will receive a welcome kit containing your account details and instructions on how to activate your account.

3-in-1 Account

Both IIFL and Angel One offer 3-in-1 accounts, which include a trading account, demat account, and a savings bank account. To open a 3-in-1 account with either broker, you will need to follow the same process as opening a trading and demat account.

Both IIFL and Angel One make opening and maintaining your trading and demat accounts easy. However, it’s important to consider the account opening and maintenance charges before making your decision.

Brokerage and Charges

When choosing a stockbroker, one of the most important factors you need to consider is brokerage and charges. In this section, we will take a closer look at the brokerage and charges of IIFL Securities and Angel One.

Here is a table that compares the brokerage and charges of IIFL Securities and Angel One:

| Brokerage and Charges | IIFL Securities | Angel One |

|---|---|---|

| Brokerage Charges for Equity Delivery | Rs. 20 per order | Free |

| Brokerage Charges for Equity Intraday | Rs. 20 per order | Rs. 20 per executed order |

| Transaction Charges | 0.00325% of Total Turnover | 0.00325% of Total Turnover |

| Other Charges | Account Opening Charges: Rs. 750 | Account Opening Charges: Rs. 699 |

As you can see from the table, both IIFL Securities and Angel One charge brokerage fees for equity delivery and intraday trading. However, Angel One offers free brokerage for equity delivery, which is a significant advantage.

In terms of transaction charges, both brokers charge the same amount, which is 0.00325% of the total turnover. This means you will pay the same transaction charges regardless of which broker you choose.

Apart from brokerage and transaction charges, there are other charges that you need to consider when choosing a stockbroker. For example, account opening and annual maintenance charges (AMC) can increase over time.

IIFL Securities charges an demat account opening is free, while Angel One also provides free account opening. In terms of AMC charges, IIFL Securities charges Rs. 250 per year, while Angel One offers Rs. 240 per year.

It is also worth noting that both brokers have a minimum brokerage charge. IIFL Securities charges a minimum brokerage of Rs. 35 per trade, while Angel One charges a minimum brokerage of Rs. 20 per trade.

Overall, when it comes to brokerage and charges, Angel One seems to have an edge over IIFL Securities, especially in terms of free brokerage for equity delivery and lower demat account opening charges. However, it is important to consider all the other factors as well before making a decision.

Trading Options and Securities

When it comes to trading options and securities, both IIFL and Angel One offer a wide range of options for their clients. Let’s take a closer look at what each broker has to offer:

Stock Trading

Both IIFL and Angel One allow you to trade stocks on major exchanges in India. IIFL Securities charges a brokerage fee of Rs. 20 per trade, while Angel One charges a similar fee of Rs. 20 per trade.

Options Trading

Both brokers also offer this service if you’re interested in trading options. Angel One charges a transaction fee of Rs. 5300 per Cr (0.053%) on premium, while IIFL Securities charges a similar fee of Rs. 5100 per Cr (0.051%) on premium.

Equity Trading

Both brokers also allow you to trade equity in delivery and intraday. With IIFL Securities, you can trade equity delivery at a brokerage fee of 0.50% of the transaction value. The brokerage fee is 0.05% of the transaction value for equity intraday. On the other hand, Angel One charges a brokerage fee of 0.40% for equity delivery and 0.01% for equity intraday.

Currency Trading

IIFL Securities offers currency trading in both futures and options. The brokerage fee for currency futures is 0.05% of the transaction value, while the brokerage fee for currency options is Rs. 20 per lot. Angel One also offers currency trading in both futures and options with a similar brokerage fee structure.

Commodity Trading

Both brokers allow you to trade commodities on major exchanges in India. IIFL Securities charges a brokerage fee of 0.05% of the transaction value, while Angel One charges a similar fee of 0.04% of the transaction value.

Margin Trading

Both brokers offer margin trading, allowing you to trade with leverage. IIFL Securities offers up to 10x leverage on equity delivery and up to 3x leverage on equity intraday. Angel One offers up to 20x leverage on equity delivery and up to 10x leverage on equity intraday.

Overall, both IIFL and Angel One offer a wide range of options for trading securities. It’s important to compare the fees and services offered by each broker to determine which one is best for your specific needs.

Research and Advisory

When it comes to research and advisory services, both IIFL and Angel One offer solid options.

IIFL Securities provides research reports and recommendations across various equity, derivatives, and commodities segments. They also have a dedicated team of research analysts who provide insights on market trends and investment opportunities. Their research reports cover fundamental and technical analysis, along with company updates and news. Additionally, IIFL Securities also offers personalized advisory services to its clients, where they can interact with their relationship managers and get customized recommendations based on their investment goals.

Angel One also provides research reports and recommendations across various equity, derivatives, and commodities segments. They have a team of research analysts who provide insights on market trends and investment opportunities. Their research reports cover fundamental and technical analysis, along with company updates and news. Angel One also offers personalized advisory services to its clients, where they can interact with their relationship managers and get customized recommendations based on their investment goals.

Both IIFL and Angel One offer their clients solid research and advisory services. It would be best to review their research reports and recommendations to understand which aligns with your investment goals and preferences.

Customer Support and Reviews

When it comes to trading, customer support is an essential aspect that can make or break your experience. Both IIFL Securities and Angel One offer customer support through various phone, email, and chat channels.

IIFL Securities has a dedicated customer support team that is available from 9:00 am to 7:00 pm on weekdays. You can reach them via phone, email, or chat. They also have an extensive FAQ section covering the most common queries on their website. Additionally, they have a presence on social media platforms such as Twitter and Facebook, where you can reach out to them.

Angel One also offers customer support through phone, email, and chat. They have a separate helpline number for their customers, which is available from 8:30 am to 6:00 pm on weekdays. They also have an extensive knowledge base on their website, covering the most common queries.

When it comes to customer reviews, both IIFL Securities and Angel One have a good reputation in the market. According to customers, Angel One is rated 4.2 out of 5, while IIFL Securities is rated 3.9 out of 5.

However, it’s important to note that customer reviews can be subjective and may not reflect your experience. It’s always a good idea to do your research and read multiple reviews before making a decision.

In conclusion, both IIFL Securities and Angel One offer good customer support through various channels. They also have a good reputation in the market, as reflected by their customer ratings.

Advantages and Disadvantages

When it comes to choosing between IIFL and Angel One, there are several advantages and disadvantages to consider. Here’s a breakdown of what you need to know:

Advantages of IIFL Securities

- Full-service broker: IIFL Securities is a full-service broker, meaning that they offer a wide range of investment services, including research, advisory, and portfolio management. This can be especially helpful if you’re new to investing or if you prefer to have a professional manage your investments.

- Wide range of investment options: IIFL Securities offers a wide range of investment options, including equities, derivatives, commodities, and currencies. This means that you can invest in a variety of assets, depending on your risk tolerance and investment goals.

- Advanced trading platforms: IIFL Securities offers advanced trading platforms that are designed to meet the needs of both novice and experienced traders. Their platforms are user-friendly and offer a range of features, including real-time quotes, customizable charts, and technical analysis tools.

Disadvantages of IIFL Securities

- Higher brokerage fees: IIFL Securities charges higher brokerage fees compared to discount brokers like Angel One. This can eat into your profits, especially if you’re a frequent trader.

- Limited branch network: While IIFL Securities has a large branch network, it’s still not as extensive as some of the other full-service brokers in India. This can be a disadvantage if you prefer to have a physical branch nearby.

Advantages of Angel One

- Discount broker: Angel One is a discount broker, meaning they offer lower brokerage fees than full-service brokers like IIFL Securities. This can be especially advantageous if you’re a frequent trader.

- Large branch network: Angel One has a large branch network, with over 900 branches across India. This can be helpful if you prefer to have a physical branch nearby.

- User-friendly trading platforms: Angel One offers user-friendly, easy-to-use, and navigate trading platforms. They also offer a range of features, including real-time quotes, customizable charts, and technical analysis tools.

Disadvantages of Angel One

- Limited investment options: Angel One offers limited investment options compared to full-service brokers like IIFL Securities. They only offer equities, derivatives, and commodities, which may not be enough for some investors.

- Limited research and advisory services: Angel One offers limited research and advisory services compared to full-service brokers like IIFL Securities. This can be a disadvantage if you’re new to investing or if you prefer to have a professional manage your investments.

Conclusion

In conclusion, both IIFL Securities and Angel One are great options for investors looking to trade in the Indian stock market. However, there are some key differences between the two that you should consider before making your final decision.

If you’re looking for a discount broker with a user-friendly platform and low brokerage fees, Angel One may be your better choice. With 900 branches across India and a strong research team, they offer a wide range of investment options and tools to help you make informed decisions.

On the other hand, if you prefer a full-service broker with a more personalized approach, IIFL Securities may be a better fit. They offer a range of investment options, including mutual funds and IPOs, and have a dedicated team of advisors to help you navigate the market.

Ultimately, the decision between IIFL Securities and Angel One comes down to your individual needs and preferences. Consider factors such as brokerage fees, investment options, research tools, and customer support before making your final choice.

Frequently Asked Questions

Which is better for trading, IIFL or Angel One?

Both IIFL and Angel One are reputable brokers in India and offer similar trading services. However, the choice between the two ultimately depends on your personal preferences and trading needs. It’s recommended that you compare the features, fees, and customer support of both brokers before making a decision.

What are the differences between IIFL and Angel One?

IIFL is a full-service broker, while Angel One is a discount broker. IIFL offers a wider range of investment options and research reports but charges higher brokerage fees. On the other hand, Angel One offers lower brokerage fees but has limited investment options. Additionally, IIFL has a larger presence in India with more branches across the country.

Is Angel One a good choice for beginners?

Yes, Angel One is a good choice for beginners. The broker offers a user-friendly trading platform, educational resources, and research reports to help beginners learn about trading. Additionally, the low brokerage fees make it an affordable option for those who are just starting out.

Can I open a trading account with Angel One without a minimum deposit?

Yes, you can open a trading account with Angel One without a minimum deposit. However, you will need to maintain a minimum balance of Rs. 10,000 in your account to avoid inactivity charges.

What are the fees and charges for trading with IIFL and Angel One?

The fees and charges for trading with IIFL and Angel One vary depending on the type of account and the investment options you choose. It’s recommended that you check the respective websites of these brokers for detailed information on fees and charges.

Which one offers better customer support, IIFL or Angel One?

Both IIFL and Angel One offer good customer support. Both brokers have a strong online presence with chat, email, and phone support. Additionally, IIFL has a larger number of branches across India, which may make it easier for customers to access in-person support.

What are the key differences between IIFL and Angel One as stockbrokers?

IIFL and Angel One are both renowned stockbrokers, but they may differ in various aspects such as brokerage charges, account opening fees, AMC charges, customer service, and the range of investment options like mutual funds, currency futures, equity futures, commodity futures, and currency options.

Can you explain the concept of a sub-broker in the context of IIFL and Angel One?

A sub-broker is an individual or entity affiliated with a brokerage firm like IIFL or Angel One to provide brokerage services to clients. Sub-brokers act as intermediaries between the main brokerage and clients, facilitating trades and managing client accounts.

What is the account opening charge for IIFL and Angel One?

As of my last update in September 2021, the account opening charges for IIFL and Angel One may vary. Investors should check their respective websites or contact customer support for specific information on account opening charges.

Are there any AMC charges for maintaining a demat account with IIFL and Angel One?

Yes, both IIFL and Angel One may have AMC charges for maintaining a demat account. These charges may differ based on the type of demat account and services availed. It is advisable to check the latest AMC details on their respective websites.

Can NRIs (Non-Resident Indians) trade with IIFL and Angel One?

Yes, both IIFL and Angel One offer NRI trading services, allowing Non-Resident Indians to invest in the Indian stock market. Specific requirements and procedures can be found on their websites or by contacting customer support.

What are the currency futures and options trading facilities offered by IIFL and Angel One?

Both IIFL and Angel One provide currency futures and options trading facilities. Investors can trade in currency derivatives to speculate on currency exchange rate movements and manage currency risk.

How do I compare IIFL and Angel One to choose the best discount broker?

To compare IIFL and Angel One, investors should consider factors such as brokerage charges, account opening fees, AMC charges, available investment options, customer service, research reports like the daily market report, and the ease of trading with features like a trading account opening fee and pledge invocation charges. Analyzing these factors can help investors make an informed decision based on their specific trading needs and preferences.