Kotak Securities vs Angel One: Which is the Best Demat?

This is a Comparision of the Kotak Securities and Angel One.

In fact, I have been using this Demat account for more than two years.

In this post, I compare Kotak Securities vs Angel One in terms of:

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Product and Services

- Pros and Cons

Let’s get started.

Summary of Kotak Securities vs Angel One

| Kotak Securities | Angel One | |

|---|---|---|

| Type | Full-Service Broker | Full-Service Broker |

| Year Founded | 1994 | 1987 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 4.1 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% or Rs. 20 per executed order, whichever is lower | 0.03% or Rs. 20 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 42 branches | More than 110 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | N/A |

| Ranking | 8th | 6th |

Overview of Kotak Securities and Angel One

When it comes to Choosing a brokerage firm, you want to make sure you pick one that is reliable, trustworthy and has a good track record. There are Many brokerage firms to choose from in India, but two of the most popular ones are Kotak Securities and Angel One.

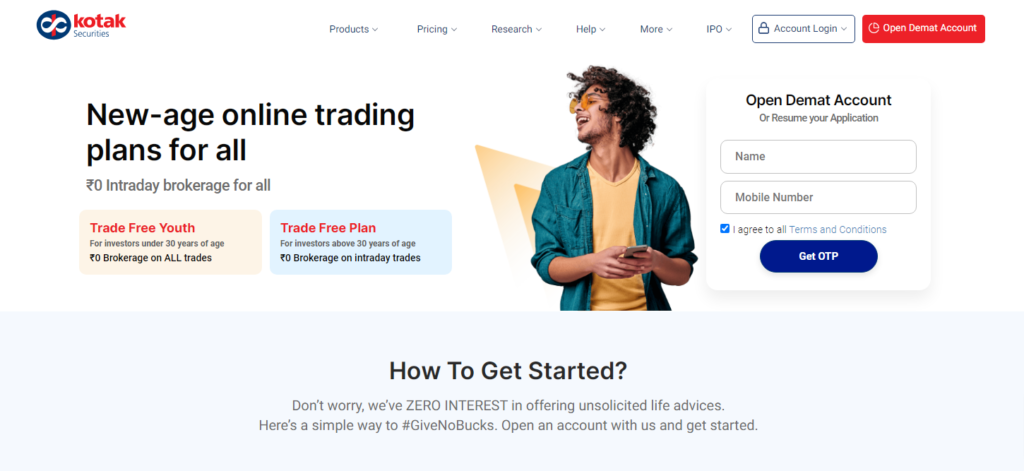

Kotak Securities was incorporated in 1994 and is a full-service broker. It offers trading at BSE, NSE, MCX, and NCDEX. Kotak Securities has more than 42 branches across India and is a subsidiary of Kotak Mahindra Bank, one of the leading banks in India. With over 25 years of experience in the securities industry, Kotak Securities has established itself as a trustworthy and reliable broker.

On the other hand, Angel One was incorporated in 1987 and is a discount broker. It offers trading at BSE, NSE, MCX, and NCDEX. Angel One has more than 110 branches across India and is one of the largest retail brokers in India. With over 30 years of experience in the securities industry, Angel One has established itself as a popular and well-respected broker.

Both Kotak Securities and Angel One offer a range of services to their clients, including online trading, research and analysis, and investment advice. However, you should be aware of some differences between the two brokers.

Kotak Securities is a full-service broker, which means that it offers its clients a wide range of services, including research and analysis, investment advice, and personalized portfolio management. On the other hand, Angel One is a discount broker, which means that it offers lower brokerage rates but may not offer as many services as a full-service broker.

In summary, both Kotak Securities and Angel One are popular and well-respected brokers in India. Kotak Securities is a full-service broker with 25 years of experience in the securities industry, while Angel One is a discount broker with over 30 years of experience. Depending on your needs and preferences, you may prefer one broker over the other.

Account Opening

Are you planning To open an account with either Kotak Securities or Angel One? You need to know here about their Demat Account opening process and charges.

| Broker | Account Opening Charges | Demat Account Annual Maintenance Charges |

|---|---|---|

| Kotak Securities | Rs. 0 | Rs. 600 |

| Angel One | Rs. 0 | Rs. 240 |

Both brokers offer free account openings. However, Kotak Securities charges a higher annual maintenance fee for their demat account compared to Angel One.

If you’re looking for a 3-in-1 account, Kotak Securities offers one that includes a demat account, an online Trading account with Kotak Securities, and a bank account with Kotak Mahindra Bank. You can fill out their online application form and submit the required Documents to open a 3-in-1 account with them.

Angel One also offers a demat account, which you can open by filling out their online application form and submitting the details of the required documents like an aadhar card and PAN card.

In summary, both Kotak Securities and Angel One offer free account opening and easy online application processes. However, Kotak Securities charges a higher annual maintenance fee for their demat account, while Angel One charges a lower fee. Kotak Securities is the way to go if you’re looking for a 3-in-1 account.

Brokerage and Charges

When it comes to choosing a stockbroker, one of the most important factors to consider is the brokerage and charges. In this section, we will compare the brokerage and charges of Kotak Securities and Angel One.

Here is a table comparing the brokerage and charges of Kotak Securities and Angel One:

| Brokerage and Charges | Kotak Securities | Angel One |

|---|---|---|

| Brokerage | Ranges between Rs. 20 per order | Ranges between Rs. 20 per order |

| Transaction Charges | Equity Future is NSE: 0.0019%, and Equity Options is NSE: 0.05% on Premium | Equity Future is NSE Rs 190 per Cr (0.0019%), and Equity Options is NSE Rs 5000 per Cr (0.05%) |

| Minimum Brokerage | Rs 20 | Rs 20 |

| Brokerage Calculator | Available | Available |

| Brokerage Plans | Multiple plans available | Multiple plans available |

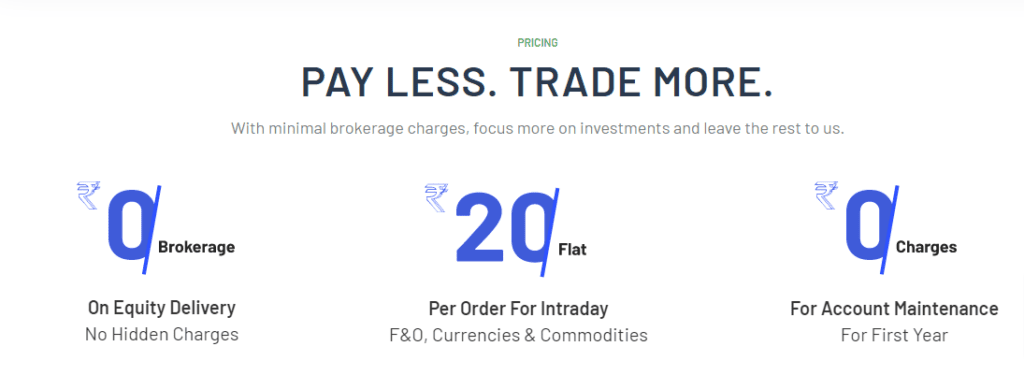

| Zero Brokerage | Not available | Yes |

| Other Charges | STT, GST, SEBI Charges, Stamp Duty, and Transaction Charges | STT, GST, SEBI Charges, Stamp Duty, and Transaction Charges |

As you can see, both Kotak Securities and Angel One offer free trading and Demat account opening charges. However, Kotak Securities charges a higher demat account AMC fee of Rs 600, while Angel One charges only Rs 240.

In terms of brokerage, both brokers charge for equity delivery and Intraday trading a minimum of Rs. 20 per order. Kotak Securities has a minimum brokerage of Rs 20, while Angel One has a minimum brokerage of Rs 20. Both brokers offer a brokerage calculator and multiple brokerage plans.

When it comes to transaction charges, Kotak Securities charges lower rates for equity futures and options. On the other hand, Angel One charges lower rates for equity futures and options on premiums.

It’s important to note that both brokers charge additional fees such as STT, GST, SEBI charges, stamp duty, and transaction charges.

Overall, both Kotak Securities and Angel One offer competitive brokerage and charges. It’s important to consider your trading habits and requirements before choosing a broker.

Products and Services

Regarding products and services, both Kotak Securities and Angel One offer their clients a wide range of investment options. Here are some of the key products and services that you can expect from both brokers:

Equity Trading

Both Kotak Securities and Angel One offer equity trading services to their clients. With Kotak Securities, you can trade on both BSE and NSE, while Angel One offers trading on BSE, NSE, and MCX.

Options and Futures

If you’re interested in trading options and futures, both brokers have got you covered. Kotak Securities offers trading in equity options, currency futures, and currency options, while Angel One offers trading in equity options, futures, and currency derivatives.

Commodity Trading

Both brokers also offer commodity trading services. Kotak Securities offers to trade on MCX and NCDEX, while Angel One offers to trade on MCX and NCDEX as well as offers to trade in commodity options.

Mutual Funds

If you’re looking to invest in mutual funds, both brokers offer a range of options. Kotak Securities offers investment in mutual funds through its trading account, while Angel One offers investment in mutual funds through its mutual fund investment platform.

Margin Trading

Both brokers offer margin trading services to their clients. With Kotak Securities, you can trade on margin in equity and commodity segments, while Angel One offers margin trading in equity.

Insurance

In addition to trading and investment services, both brokers offer their clients insurance products. Kotak Securities offers a range of insurance products, including life insurance and general insurance, while Angel One offers health insurance products.

Trading Platforms

Both brokers offer trading platforms that allow you to trade and invest online. Kotak Securities offers KEAT Pro X, a trading platform that allows you to trade on BSE, NSE, and MCX, while Angel One offers

Angel One App a mobile trading app that allows you to trade on BSE, NSE, and MCX.

Advisory Services

Both brokers also offer advisory services to their clients. Kotak Securities offers its clients research reports, investment ideas, and market insights, while Angel One offers personalized investment advice and research reports.

Other Services

Both brokers also offer a range of other services, including IPOs, margin funding, and NRI services. Kotak Securities also offers a Trade Free Plan, allowing you to trade without paying brokerage charges. Angel One offers a range of plans to suit different trading needs and styles.

Overall, both Kotak Securities and Angel One offer their clients a comprehensive range of products and services. Whether you’re a Beginner or an experienced trader, you’re sure to find a product or service that suits your needs.

Research and Advisory

When it comes to research and advisory services, both Kotak Securities and Angel One offer a range of tools and resources to help you make informed investment decisions. Here’s a quick overview of what you can expect from each broker:

Kotak Securities

Kotak Securities has a dedicated research team that provides daily, weekly, and monthly reports on the Indian stock market. These reports cover a range of topics, including market trends, sector analysis, and individual stock recommendations. You can access these reports on the Kotak Securities Website or through the mobile app.

In addition to research reports, Kotak Securities also offers a range of other tools and resources to help you stay informed. These include:

- Live market updates: Get real-time updates on stock prices, indices, and other market data.

- Expert opinions: Access insights and analysis from Kotak Securities experts on market trends and investment opportunities.

- Trading ideas: Get trading ideas and recommendations based on market trends and technical analysis.

Angel One

Angel One also has a research team that provides regular reports and analyses on the Indian stock market. These reports cover a range of topics, including market trends, sector analysis, and individual stock recommendations. You can access these reports on the Angel One website or through the mobile app.

In addition to research reports, Angel One offers various other tools and resources to help you make informed investment decisions. These include:

- ARQ: Angel One’s proprietary robo advisory engine that provides personalized investment recommendations based on your risk profile and investment goals.

- Expert advice: Access insights and analysis from Angel One experts on market trends and investment opportunities.

- Trading ideas: Get trading ideas and recommendations based on market trends and technical analysis.

Overall, both Kotak Securities and Angel One offer a range of research and advisory services to help you make informed investment decisions. Whether you prefer to do your own research or rely on expert advice, both brokers have the tools and resources you need to succeed.

Customer Support and Experience

Regarding customer support, Kotak Securities and Angel One offer various channels to assist you with your queries and concerns. You can reach out to them via phone, email, or chat support. Kotak Securities also has a customer care center in Mumbai, where you can visit in person for assistance.

In terms of experience, both brokers have user-friendly platforms that are easy to navigate. Angel One provides a mobile app that is highly rated for its ease of use and features. Kotak Securities also offers a well-designed mobile app that provides a seamless trading experience.

If you are looking for a special offer, both brokers have occasional promotions and discounts for new customers. However, it is important to note that these offers may come with certain terms and conditions, so make sure to read the fine print before signing up.

Overall, both Kotak Securities and Angel One provide friendly customer support and a good trading experience. It ultimately comes down to your personal preferences and requirements when choosing between the two.

Pros and Cons

When it comes to choosing between Kotak Securities and Angel One, there are several pros and cons to consider. Here are some of the key points to keep in mind:

Pros

Kotak Securities

- Full-service broker: Kotak Securities offers a wide range of investment options, including equities, derivatives, currencies, and commodities. They also provide research reports, investment advice, and other value-added services that can help you make informed decisions.

- Strong brand reputation: Kotak Securities is part of Kotak Mahindra Group, India’s most respected financial institution. Knowing that your investments are in good hands can give you peace of mind.

- Robust trading platforms: Kotak Securities offers a variety of trading platforms, including KEAT Pro X, Fastlane, and Xtralite. These platforms are user-friendly and offer advanced features that can help you trade more effectively.

Angel One

- Discount broker: Angel One offers low brokerage fees, making it an attractive option for investors who want to keep their costs down. They also offer a flat fee of Rs. 20 per trade, regardless of the size of the trade.

- Wide range of investment options: Angel One offers a variety of investment options, including equities, derivatives, currencies, and commodities. They also provide research reports and other tools to help you make informed decisions.

- User-friendly trading platforms: Angel One offers a variety of trading platforms, including the Angel One App, Angel SpeedPro, and Angel BEE. These platforms are easy to use and offer a range of features that can help you trade more effectively.

Cons

Kotak Securities

- Higher brokerage fees: Kotak Securities charges higher brokerage fees compared to Angel One. This can make it more expensive to trade, especially if you are a frequent trader.

- Limited branch network: Although Kotak Securities has a strong brand reputation, they only have 153 branches across India. This can make it difficult to access their services if you live in a remote area.

- No free trading: Unlike some other brokers, Kotak Securities does not offer free trading. This means you must pay brokerage fees on all your trades.

Angel One

- Limited research reports: Although Angel One offers research reports, they are not as comprehensive as those offered by some other brokers. This can make it more difficult to make informed investment decisions.

- Limited offline presence: Although Angel One has a wide range of online services, they have a limited offline presence. This can make it difficult to access their services if you prefer to deal with someone face-to-face.

- No commodity trading: Unlike Kotak Securities, Angel One does not offer commodity trading. This can be a disadvantage if you are interested in trading commodities.

Conclusion

Now that you have compared Kotak Securities and Angel One, you should know which broker better fits you. Both brokers offer a range of investment options and have their own unique features.

If you are looking for a broker with lower brokerage charges for equity trading, then Angel One might be a better fit for you. On the other hand, if you are looking for a broker that offers a 3-in-1 account with a bank account, then Kotak Securities might be a better fit.

When it comes to customer service, both brokers have received positive reviews. However, Kotak Securities has been rated higher for its research and analysis tools.

Ultimately, the choice between Kotak Securities and Angel One depends on your individual needs and preferences. Take the time to consider the factors that are most important to you, such as brokerage charges, investment options, and customer service, before making a decision.

Regardless of Which broker you choose, it is important to do your own research and make an informed decision. With the right broker and investment strategy, you can achieve your financial goals and build a strong portfolio over time.

Frequently Asked Questions

Which is better, Kotak Securities or Angel One?

Deciding which broker is better between Kotak Securities and Angel One depends on your investment goals and preferences. Both brokers are registered with SEBI and offer investment in equity, F&O, currency, and commodities. However, Kotak Securities charges a brokerage fee of 0.25% (minimum Rs. 20 per trade) for equity and free for intraday, whereas Angel One charges Rs. 0 (free) for equity and Rs. 20 per executed order for intraday.

What are the differences between Angel One and Kotak Securities?

The major difference between Kotak Securities and Angel One is their brokerage charges. Kotak Securities charges 0.25% (minimum Rs. 20 per trade) for equity and free for intraday, whereas Angel One charges Rs. 0 (free) for equity and Rs. 20 per executed order for intraday. Additionally, Kotak Securities offers a 3-in-1 account that integrates your bank, trading, and demat accounts, while Angel One offers a 2-in-1 account that integrates your trading and demat accounts.

Is Kotak Securities brokerage higher than Angel One?

Yes, Kotak Securities brokerage is higher than Angel One. Kotak Securities charges 0.25% (minimum Rs. 20 per trade) for equity and free for intraday, whereas Angel One charges Rs. 0 (free) for equity and Rs. 20 per executed order for intraday.

Can I trust Kotak Securities with my investments?

Yes, Kotak Securities is a trustworthy broker. It is a subsidiary of Kotak Mahindra Bank, one of India’s leading private sector banks, and has been in the business for over 25 years. Kotak Securities is also registered with SEBI and is a BSE, NSE, and MCX member.

What are the disadvantages of opening a demat account with Kotak Securities?

One of the main disadvantages of opening a demat account with Kotak Securities is its higher brokerage charges compared to other brokers. Additionally, Kotak Securities charges an annual maintenance fee of Rs. 50 for Basic Services Demat Account (BSDA) and Rs. 750 for regular demat accounts.

Which is a better option, Upstox, Zerodha, or Kotak Securities?

Choosing the right broker depends on your investment goals and preferences. Upstox and Zerodha are discount brokers, which means they offer lower brokerage charges than traditional brokers like Kotak Securities. However, Kotak Securities offers a 3-in-1 account that integrates your bank, trading, and demat accounts, which can be convenient for some investors. Ultimately, it’s best to compare the features, brokerage charges, and services offered by each broker before making a decision.

Is Sharekhan associated with the National Stock Exchange (NSE)?

Yes, Sharekhan is a registered member of the National Stock Exchange of India (NSE) and provides trading facilities for NSE-listed securities.

Does Angel One provide a margin trading facility to its customers?

Yes, Angel One offers a margin trading facility, allowing customers to trade with leverage and borrow funds to increase their trading exposure.

Is Kotak Securities Ltd. the same as Kotak Bank?

Yes, Kotak Securities Ltd. is a subsidiary of Kotak Mahindra Bank, which is one of India’s leading private sector banks.

Does Sharekhan provide an instant account opening facility?

Yes, Sharekhan offers an instant account opening facility called “Express Account,” which allows customers to open a trading and demat account quickly online without the need for physical documentation.

What are the AMC charges for a demat account with Kotak Securities?

The Annual Maintenance Charges (AMC) for a demat account with Kotak Securities vary based on the type of demat account and services availed. It is advisable to check the latest AMC details on the Kotak Securities website or by contacting their customer support for accurate and up-to-date information.