5paisa vs Upstox: Which is Best for You?

In this post, I’m going to compare 5paisa and upstox.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare 5paisa vs Upstox in terms of:

- Overview

- Account Opening and Maintenance charges

- Brokerage Charges

- Trading Platform

- Investment Option

- Advantages and Disadvantages

Let’s get started.

Summary of 5paisa vs Upstox

| 5paisa | Upstox | |

|---|---|---|

| Type | Discount Broker | Discount Broker |

| Year Founded | 2016 | 2011 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 4.2 out of 5 | 4.0 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .05%, whichever is lower | Rs 20 per executed order or 0.05% whichever is low |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No branches | More than 1000 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 24+ | 24+ |

| Ranking | 5th | 2nd |

Overview of 5paisa and Upstox

If you’re looking for a Discount broker in India, 5paisa and Upstox are two of the most popular options available. Both offer low brokerage fees and a range of services to help you manage your investments.

5paisa is a Mumbai-based discount broker that was launched in 2016. It is a subsidiary of IIFL Holdings Limited, a financial services company. 5paisa offers a range of services, including trading in equities, derivatives, currencies, and commodities. It also offers mutual fund investments, insurance, and loans.

Upstox, on the other hand, is a discount broker based in Mumbai that was launched in 2009. It is backed by investors such as Ratan Tata, Kalaari Capital, and GVK Davix. Upstox offers trading in equities, derivatives, currencies, and commodities. It also offers mutual funds and IPO investments.

When it comes to brokerage fees, both 5paisa and Upstox charge low fees. 5paisa charges Rs. 20 per executed order for equity trading and intraday trading. Upstox also charges Rs. 20 per executed order for equity trading and intraday trading. However, Upstox also offers a plan where you can trade for free in the equity delivery segment.

In terms of services, both 5paisa and Upstox offer a range of tools and resources to help you manage your investments. 5paisa offers a mobile app and a web platform that allows you to trade, invest, and manage your portfolio. It also offers research reports and a learning center to help you improve your investing skills. Upstox offers a mobile app and a web platform as well. It also offers a range of tools, including charting tools, technical analysis tools, and trading strategies.

Overall, both 5paisa and Upstox are good discount brokers that offer low brokerage fees and a range of services to help you manage your investments. The choice between the two will depend on your specific needs and preferences.

Account Opening Process

Opening a Trading and Demat account is the first step towards investing in the stock market. In this section, we will compare the account opening process of 5paisa and Upstox.

Before we dive into the Account opening process, let’s take a look at the charges for opening and maintaining a demat account with 5paisa and Upstox.

| Broker | Account Opening Charges | Demat Account Opening Charges | Trading Account Opening Charges | Account Maintenance Charges |

|---|---|---|---|---|

| 5paisa | Rs 0 (Free) | Rs 0 (Free) | Rs 0 (Free) | Rs 300/year |

| Upstox | Rs 0 (Free) | Rs 0 (Free) | Rs 0 (Free) | Rs 150/year |

As you can see, both brokers offer free Demat account opening, but Upstox charges a nominal fee of Rs 150 for Opening a Demat account. However, Upstox’s demat account maintenance charges are lower than 5paisa.

Account Opening Process

5paisa Account Opening Process

To open a Demat account with 5paisa, you need to follow these steps:

- Visit the 5paisa Website and click on the ‘Open a Free Account’ button.

- Enter your mobile number and click on ‘Send OTP’.

- Enter the OTP received on your mobile and click on ‘Verify OTP’.

- Fill in your personal details, bank details, and upload your PAN and Aadhaar card.

- Once your application is approved, you will receive an email with your login credentials.

Upstox Account Opening Process

To open a Demat account with Upstox, you need to follow these steps:

- Visit the Upstox Website and click on the ‘Open Account’ button.

- Enter your mobile number and click on ‘Get Started’.

- Fill in your Documents, details and upload your PAN and Aadhaar card and bank details.

- Once your application is approved, you will receive an email with your login credentials.

Both brokers offer a seamless and hassle-free account opening process. However, Upstox’s Demat account opening process is slightly simpler as it does not require OTP verification.

In conclusion, both 5paisa and Upstox offer free demat account openings with nominal maintenance charges. The account opening process for both brokers is straightforward, and you can open a demat account within a few minutes.

Brokerage and Other Charges

When it comes to choosing a stockbroker, one of the most important factors to consider is the brokerage and other charges. Here is a table comparing the brokerage and other charges of 5paisa and Upstox:

| Brokerage and Other Charges | 5paisa | Upstox |

|---|---|---|

| Brokerage for Equity Delivery | ₹20 per executed order | ₹20 per executed order or 2.5%, whichever is lower |

| Brokerage for Equity Intraday | ₹20 per executed order | ₹20 per executed order or 0.05% whichever is lower |

| Minimum Brokerage | ₹20 per trade | ₹20 per trade |

| Turnover Charges | NSE: 0.00325% and BSE: 0.003% | NSE: 0.00325% and BSE: 0.003% |

| AMC Charges | Holding < Rs.50,000 You need to pay Rs. 75 per quarter | ₹150 per year |

As you can see, both 5paisa and Upstox have similar brokerage charges for equity delivery and intraday trading. However, Upstox offers a lower brokerage rate of 2.5% for equity delivery trades, making it more cost-effective for larger trades. Both brokers charge a minimum brokerage of ₹20 per trade, which is the same as their brokerage charges.

In terms of turnover charges, both brokers charge the same rate of 0.00325% for NSE trades and 0.003% for BSE trades. However, it’s worth noting that these charges can add up quickly, especially if you’re a frequent trader.

When it comes to AMC charges, Upstox offers a major advantage of a low charge of Rs. 150 per year AMC fees for its Demat account. On the other hand, 5paisa charges an annual AMC no fee if you hold less than Rs 50000 if you hold more than Rs 50000, you need to pay Rs. 75 per quarter for its demat account.

Overall, both 5paisa and Upstox have similar brokerage and other charges. However, depending on your trading volume and preferences, one broker may be more cost-effective than the other.

Trading Platforms and Features

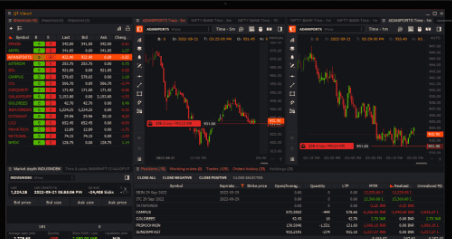

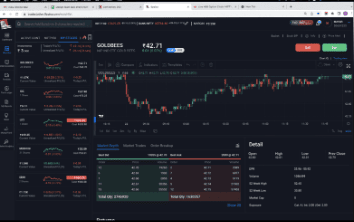

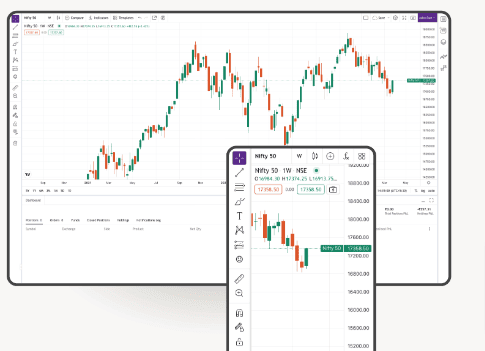

When it comes to trading platforms, both 5paisa and Upstox offer web-based platforms and mobile apps that are easy to use and navigate. Both platforms provide a variety of tools and features to help traders monitor and manage their investments.

5paisa’s trading platform is user-friendly and offers a wide range of features, such as advanced charting, real-time stock quotes, and multiple watchlists. The platform also provides comprehensive market analysis, research reports, and a range of trading tools, such as margin calculators, option chains, and more. 5paisa’s mobile app is also well-designed and provides real-time market updates, live streaming of stock prices, and quick order placement.

Upstox’s trading platform is also user-friendly, and it offers a range of features such as advanced charting, real-time stock quotes, and multiple watchlists. The platform also provides comprehensive market analysis, research reports, and a range of trading tools, such as margin calculators, option chains, and more. Upstox’s mobile app is also well-designed and provides real-time market updates, live streaming of stock prices, and quick order placement.

Both platforms offer a range of order types, such as market orders, limit orders, stop-loss orders, and more. They also offer a range of trading software such as desktop trading software, browser trading software, and more.

In terms of trading fees, both 5paisa and Upstox offer competitive pricing. 5paisa charges a flat fee of Rs. 20 per trade across all segments, while Upstox charges a flat fee of Rs. 20 per trade for equity delivery and zero brokerage for all other segments.

Overall, both 5paisa and Upstox offer excellent trading platforms and features that cater to the needs of both novice and experienced traders.

Investment and Trading Options

When it comes to investment and trading options, both 5paisa and Upstox offer a wide range of choices. You can trade in equity, currency, commodity, and derivatives on both platforms.

Both brokers offer equity delivery, intraday, and futures for equity trading. However, 5paisa also offers equity options, which Upstox does not.

For currency trading, both brokers offer currency futures and options.

For commodity trading, both brokers offer trading in commodities.

In terms of mutual funds, both brokers offer investment in mutual funds. However, 5paisa has a slight edge as it offers direct mutual funds, which do not have any commission or distribution fees.

When it comes to stocks, both brokers offer trading in stocks. However, Upstox has a slight edge here as it offers trading in more stock exchanges than 5paisa.

Both 5paisa and Upstox offer a good range of investment and trading options. However, if you are looking for equity options, direct mutual funds, or trading in more stock exchanges, 5paisa and Upstox, respectively, would be a better choice.

Margin and Leverage

Margin and leverage are important concepts to understand when it comes to trading. Let’s take a look at how 5paisa and Upstox compare in terms of margin and leverage.

Margin Trading

Margin trading allows you to buy stocks by paying only a fraction of the total value of the stock. The broker funds the remaining amount. Both 5paisa and Upstox offer margin trading.

5paisa offers up to 20x margin on Intraday trading and up to 3x margin on delivery trading. Upstox offers up to 20x margin on intraday trading and up to 2x margin on delivery trading.

F&O Trading

Futures and options (F&O) trading involves buying and selling contracts that give you the right to buy or sell an underlying asset at a predetermined price and date. Both 5paisa and Upstox offer F&O trading with margin funding.

5paisa offers up to 3x margin on F&O trading. Upstox offers up to 4x margin on F&O trading.

Margin Funding

Margin funding is the process of borrowing money from a broker to buy stocks. Both 5paisa and Upstox offer margin funding.

5paisa offers margin funding at an interest rate of 18% per annum. Upstox offers margin funding at an interest rate of 18% per annum.

Leverage

Leverage is the amount of money you can borrow from a broker to trade. Both 5paisa and Upstox offer leverage.

5paisa offers up to 20x leverage on intraday trading and up to 3x leverage on delivery trading. Upstox offers up to 20x leverage on intraday trading and up to 2x leverage on delivery trading.

Overall, both 5paisa and Upstox offer similar margin and leverage options. However, it is important to note that margin trading and margin funding involve a higher level of risk and should only be used by experienced traders who understand the risks involved.

Additional Information

When it comes to choosing the right stockbroker for your trading needs, there are several factors to consider. In addition to comparing the brokerage fees, trading platforms, and customer support, you may also want to look into other aspects of the broker’s services. Here are some additional pieces of information that may be relevant to your decision-making process:

- BSE and NSE Membership: Both 5paisa and Upstox are members of the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), which means they offer trading in equities, derivatives, and other securities listed on these exchanges.

- MCX Membership: If you are interested in trading commodities, you may want to consider a broker that is a member of the Multi Commodity Exchange (MCX). While Upstox is a member of MCX, 5paisa does not offer trading in commodities.

- IPOs and Insurance: If you are interested in investing in initial public offerings (IPOs) or purchasing insurance products, you may want to consider other brokers such as Zerodha, Angel One, or Fyers, as neither 5paisa nor Upstox currently offer these services.

- ProStocks Comparison: If you are considering 5paisa, you may also want to compare it with ProStocks, another popular discount broker offering lower brokerage fees and a wider range of trading platforms.

- NRI Trading: If you are a non-resident Indian (NRI) looking to trade in Indian markets, you may want to consider brokers such as Zerodha or Angel One, which offer NRI trading services.

- Call & Trade: If you prefer to place orders over the phone, you may want to consider brokers that offer call & trade services, such as Zerodha or Angel One. Both 5paisa and Upstox offer call & trade services, but they may charge additional fees for this service.

- Mumbai Offices: If you prefer to have a physical presence of your broker, both 5paisa and Upstox have offices in Mumbai, which can be convenient for face-to-face interactions.

- Founders: 5paisa is a subsidiary of IIFL Holdings Ltd, while RKSV Securities India Pvt Ltd owns Upstox.

- GST: Both 5paisa and Upstox charge Goods and Services Tax (GST) on their brokerage fees, which is currently set at 18%.

Choosing the right broker depends on your trading needs and preferences. By considering all of the relevant factors, you can make an informed decision and find a broker that suits your needs.

Advantages and Disadvantages

When it comes to choosing between 5paisa and Upstox, there are several advantages and disadvantages to consider. Here are some of the key points to keep in mind:

Advantages of 5paisa

- Low brokerage charges: 5paisa charges a flat fee of Rs. 20 per trade, which is lower than many other discount brokers in India.

- Wide range of investment options: 5paisa offers trading in stocks, derivatives, commodities, mutual funds, and insurance.

- Good mobile app: The 5paisa mobile app is user-friendly and offers a range of features, including live quotes, market news, and research reports.

- Educational resources: 5paisa provides a range of educational resources, including articles, videos, and webinars, to help investors make informed decisions.

Disadvantages of 5paisa

- Limited research: 5paisa offers some research reports and tools, but it may not be sufficient for investors requiring in-depth analysis and insights.

- Limited customer support: Some users have reported issues with customer support, including delayed responses and unhelpful representatives.

- Limited trading platforms: 5paisa offers only one trading platform, which may not be suitable for all investors.

Advantages of Upstox

- Low brokerage charges: Upstox charges a flat fee of Rs. 20 per trade, which is competitive with other discount brokers in India.

- Advanced trading platforms: Upstox offers a range of trading platforms, including Upstox Pro Web, Upstox Pro Mobile, and Upstox API, which are suitable for different types of investors.

- Good customer support: Upstox has a reputation for providing good customer support, with fast response times and helpful representatives.

- Good research tools: Upstox offers a range of research tools, including market commentaries, trading ideas, and technical analysis, to help investors make informed decisions.

Disadvantages of Upstox

- Limited investment options: Upstox offers trading in stocks, derivatives, and commodities but does not offer mutual funds or insurance.

- Limited educational resources: While Upstox offers some educational resources, it may not be sufficient for Beginners who require more guidance.

Conclusion

Based on the comparison between 5Paisa and Upstox, you can see that both brokers have their own strengths and weaknesses. Ultimately, the choice between the two comes down to your individual needs and preferences.

If you are looking for a broker with a wider range of investment options, Upstox may be your better choice. They offer trading in US stocks, which 5Paisa does not. Additionally, Upstox offers PMS services, which 5Paisa does not.

However, if you are looking for a broker with lower fees, 5Paisa may be the better option. Their fees are generally lower than Upstox’s, especially for intraday trading.

Both brokers offer user-friendly trading platforms, so choosing between the two based on platform usability may come down to personal preference.

In summary, 5Paisa and Upstox are reputable brokers offering a range of investment options and user-friendly trading platforms. Your decision between the two should be based on your individual needs and preferences.

Frequently Asked Questions

Which is better, Upstox or 5paisa?

Both Upstox and 5paisa are Popular Trading Platforms in India. While Upstox offers a wider range of products, including US stock investment and PMS services, 5paisa has a lower brokerage fee of Rs. 20 per trade. The choice between the two ultimately depends on your personal preferences and trading needs.

What are the pros and cons of using 5paisa?

The pros of using 5paisa include a low brokerage fee, easy-to-use trading platforms, and a wide range of investment options. However, some cons include occasional technical issues and limited research and analysis tools.

How does Upstox compare to other trading platforms like 5paisa and Zerodha?

Compared to 5paisa and Zerodha, Upstox offers a wider range of products and services. However, Zerodha has a lower brokerage fee than both Upstox and 5paisa.

What are the fees and charges for trading on 5paisa and Upstox?

5paisa charges a maximum brokerage fee of Rs. 20 per trade, while Upstox charges a maximum brokerage fee of Rs. 20 per trade for equity and intraday trades. Both platforms also charge additional fees for other services, such as demat account maintenance and fund transfers.

What are the unique features of Upstox and how do they compare to those of 5paisa?

Upstox offers unique features such as margin funding, a referral program, and a developer platform for building customized trading tools. While 5paisa does not offer these features, it does have a mobile app with advanced charting tools and a robo-advisory service.

Are there any security concerns with using 5paisa or Upstox?

Both 5paisa and Upstox are registered with SEBI and follow strict security protocols to protect user data and funds. However, it is always important to take precautions such as using strong passwords and enabling two-factor authentication to ensure the safety of your demat account.

What are the account opening charges for 5paisa and Upstox?

Both 5paisa and Upstox offer free Demat accounts with no account opening charges.

How is the total turnover calculated in 5paisa and Upstox?

Total turnover is calculated as the sum of all buy and sell trades executed by an investor in a specific period. Investors can find their total turnover in statements and reports provided by 5paisa and Upstox.

Which platform offers the best trading app, 5paisa, or Upstox?

Both 5paisa and Upstox offer mobile trading apps with unique features and interfaces. Investors can compare and choose the one that suits their trading preferences.

What are the brokerage charges for 5paisa and Upstox?

5paisa and Upstox both charge a flat fee of Rs.20 per trade for equity delivery and Intraday trading. Investors can compare them to find the one that fits their trading needs.

What is the transaction charge for trading in 5paisa and Upstox?

Transaction charges are fees levied by the exchanges for executing trades. Investors can refer to their respective brokerage firms for detailed transaction charge information.

How is the customer service of 5paisa and Upstox?

Both 5paisa and Upstox strive to provide good customer service. Investors can contact their customer support teams for any queries or issues.

Can investors use a credit card to fund their accounts in 5paisa and Upstox?

Investors can check with their respective brokerage firms regarding the payment methods accepted for funding their trading accounts.

Do 5paisa and Upstox offer services for intraday trading?

Yes, both 5paisa and Upstox provide services for intraday trading in various segments of the stock market.