Fyers vs Groww: Which Demat Is Best For You?

This is a Comparision of the Fyers and Groww.

In fact, I have been using this Demat account for more than a year.

In this post, I compare Fyers vs Groww in terms of:

- Overview

- Trading Platform

- Account Opening and Maintenance Charges

- Brokerage Charges

- Customer Service

- Advantages and Disadvantages

Let’s get started.

Summary of Fyers vs Groww

| Fyers | Groww | |

|---|---|---|

| Type | Discount Broker | Online Investment Platform |

| Year Founded | 2016 | 2017 |

| Headquarters | Bangalore, India | Bangalore, India |

| Overall Rating | 3.6 out of 5 | 4 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs. 20 per executed order or 0.03%, whichever is lower | Lower of Rs 20 or 0.05% per executed trade |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | 50+ | 20+ |

| Ranking | 11th | 9th |

Overview of Fyers and Groww

If you are looking for a reliable and User-friendly stockbroker in India, Fyers and Groww are two popular options that you might want to consider. Both brokers are registered with SEBI and offer a range of investment options to suit the needs of different investors.

Fyers is a Bangalore-based discount broker that was founded in 2015. It offers investment in Equity, F&O, Currency, and Commodities. One of the main advantages of Fyers is its low brokerage charges, which can be as low as zero for equity trades. Fyers also offers a range of trading tools and platforms, including a mobile app, a desktop trading terminal, and a web-based platform.

Groww, on the other hand, is a Bangalore-based online investment platform that was founded in 2016. It offers investment in Equity, F&O, and Currency. Groww’s main focus is on making investing easy and accessible for beginners and first-time investors. The platform offers a simple and intuitive user interface, a range of educational resources, and a mobile app that is designed to make investing on the go easy and hassle-free.

When it comes to fees and charges, Fyers and Groww have different pricing models. Fyers charges zero brokerage for equity trades, while Groww charges Rs 20 per executed order or 0.05% of the transaction value, whichever is lower. For Intraday trading, Fyers charges Rs 20 per executed order or 0.03% of the transaction value, whichever is lower, while Groww charges Rs 20 per executed order or 0.05% of the transaction value, whichever is lower.

In terms of ratings and reviews, both Fyers and Groww have received positive feedback from customers and industry experts. Fyers has an overall rating of 3.6 out of 5, while Groww has an overall rating of 4 out of 5. However, it is important to note that individual experiences may vary, and it is important to do your own research and due diligence before choosing a broker.

Trading Platforms

When it comes to trading platforms, both Fyers, and Groww offer their customers a range of options to choose from. Whether you prefer trading on your desktop, mobile, or web browser, both brokers have got you covered.

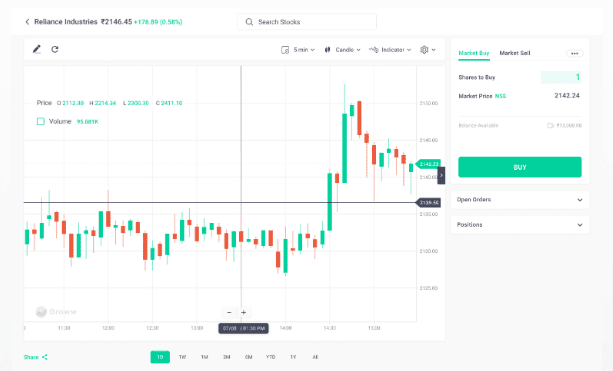

Fyers offers a desktop trading platform, Fyers One, available for Windows users. The platform comes with a range of features, including advanced charting tools, customizable workspaces, and real-time market data. Fyers One also offers a range of order types, including bracket orders and cover orders, which can help you manage your risk more effectively.

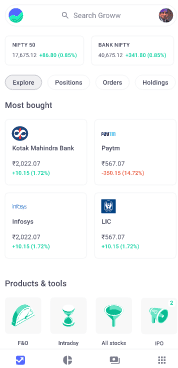

On the other hand, Groww offers a mobile app for both Android and iOS users. The app is user-friendly and easy to navigate, making it an excellent option for beginners. The app comes with a range of features, including real-time market data, watchlists, and news updates. The app also offers a range of order types, including limit orders and stop-loss orders, which can help you manage your risk more effectively.

Both brokers also offer web-based trading platforms that allow you to trade on your web browser. These platforms are accessible from any device with an internet connection, making them a convenient option for traders who are always on the go. The web-based trading platforms offered by both brokers are easy to use and come with a range of features, including real-time market data and customizable watchlists.

Overall, both Fyers and Groww offer their customers a range of trading platforms to choose from. Whether you prefer trading on your desktop, mobile, or web browser, both brokers have got you covered.

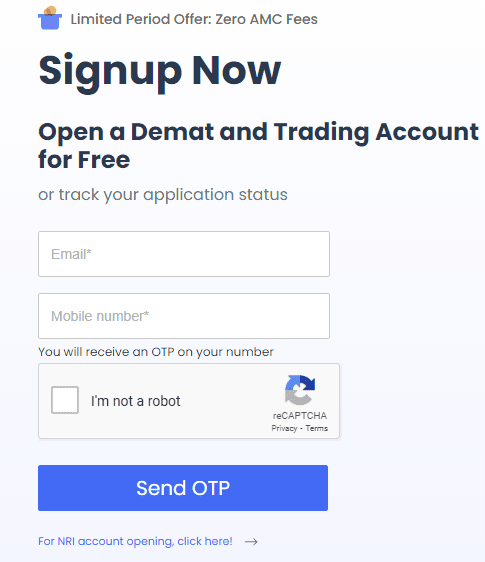

Account Opening Process

If you’re thinking of Opening a Demat account with either Fyers or Groww, you’ll be pleased to know that both brokers have a straightforward account opening process.

Here’s a table that compares the Demat account opening and maintenance charges for Fyers and Groww:

| Broker | Demat Account Opening Charges | Demat Account AMC Charges |

|---|---|---|

| Fyers | Rs 300 | Rs 300 per annum |

| Groww | Rs 0 (Free) | Rs 0 (Free) |

As you can see, both brokers offer free Trading and Demat Account openings. However, Fyers charges a demat account opening fee of Rs 300, while Groww doesn’t charge anything.

In terms of demat account AMC charges, Fyers charges Rs 300 per annum, while Groww doesn’t charge anything. This means that Groww is the more cost-effective option if you’re looking for a broker with no AMC charges.

Once you’ve decided on a broker, you can follow these steps to open an account:

- Visit the broker’s website and click on the “Open an Account” button.

- Fill in your personal details such as name, email, and phone number.

- Upload the required Documents such as PAN card, Aadhaar card, and bank statement.

- Complete the in-person verification (IPV) process by scheduling a video call with a representative from the broker.

- Fund your Demat account and start trading.

Overall, the account opening process for both Fyers and Groww is user-friendly and quick. With the above information, you can make an informed decision and choose the broker that suits your needs.

Brokerage and Other Charges

When choosing a stockbroker, one of the most important factors to consider is the fees and charges you’ll be expected to pay. In this section, we’ll compare the brokerage and other charges of Fyers and Groww to help you make an informed decision.

First, let’s take a look at a table comparing the brokerage and other charges of Fyers and Groww.

| Brokerage and Charges | Fyers | Groww |

|---|---|---|

| Equity Delivery Brokerage | Rs 0 | Rs 20 per executed order or 0.05% (whichever is lower) |

| Equity Intraday Brokerage | Rs 20 per executed order or 0.03% (whichever is lower) | Rs 20 per executed order or 0.05% (whichever is lower) |

| Minimum Brokerage | Rs 20 per trade | Rs 20 per trade |

| Hidden Charges | None | None |

| Auto Square Off Charges | Rs 20 per executed order | Rs 20 per executed order |

| Failed Instruction Charges | Rs 20 per instruction | Rs 20 per instruction |

| Demat AMC Charges | Rs 300 per year | Rs 0 per year |

As you can see, Fyers offers free equity delivery brokerage, whereas Groww charges Rs 20 per executed order or 0.05% (whichever is lower). On the other hand, Fyers charges Rs 20 per executed order or 0.03% (whichever is lower) for equity intraday, while Groww charges Rs 20 per executed order or 0.05% (whichever is lower).

Both Fyers and Groww charge a minimum brokerage of Rs 20 per trade, and neither broker has any hidden charges. Both brokers also charge Rs 20 per executed order for auto square off and Rs 20 per instruction for failed instructions.

The only significant difference in charges is the demat AMC charges. Fyers charges Rs 300 per year, while Groww charges Rs 0 per year.

Other Charges

In addition to the charges listed in the table above, it’s worth noting that both Fyers and Groww charge other fees for various services. For example, Fyers charges a fee for using its trading APIs, while Groww charges a fee for placing orders through its call and trade facility.

When choosing a broker, it’s important to be aware of these additional charges and factor them into your decision-making process.

Overall, both Fyers and Groww offer competitive brokerage and other charges, with only minor differences between the two. It’s important to consider your specific trading needs and preferences when choosing between the two brokers.

Investment Options and Services

When it comes to investment options and services, both Fyers and Groww offer a range of choices to their clients.

Investment Options

Both brokers offer Equity, F&O, Currency, and Commodities investment options. However, Groww offers investment in Equity, F&O, and Currency only.

Mutual Funds

Groww is primarily known for its mutual fund investment platform, which is one of the best in India. It offers a wide range of mutual funds, including Direct Mutual Funds, which have lower expense ratios than regular mutual funds.

Fyers also offers mutual fund investments, but it is not as well-known as Groww in this area.

Equity Trading

Both brokers offer Equity trading, including Equity Delivery and Equity Intraday. However, Fyers offers Equity Cash, which Groww does not.

Derivatives Trading

Both brokers offer Equity Options and Equity Futures trading. Fyers also offers Currency Futures trading, while Groww offers Currency Options trading.

Commodity Trading

Fyers offers Commodity trading, while Groww does not.

Gold and Sovereign Gold Bond Trading

Fyers offers Gold and Sovereign Gold Bond trading, while Groww does not.

US Stock Trading

Fyers offers US Stock trading, while Groww does not.

SIP Investing

Groww offers SIP (Systematic Investment Plan) investing, allowing you to invest a fixed amount of money regularly. Fyers does not offer this service.

Overall, both Fyers and Groww offer a range of investment options and services, but Groww is more focused on mutual fund investments, while Fyers offers a wider range of trading options, including Commodity and US Stock trading.

Customer Service and Support

When it comes to choosing a stockbroker, customer service and support are important factors to consider. Both Fyers and Groww offer their clients a range of customer support options.

Fyers Customer Service

Fyers provides customer support through various channels, including email, phone, and chat. You can also find answers to common questions on the Fyers Website’s FAQ section. Fyers has a reputation for providing prompt and friendly customer service, so you can expect to receive a quick response to any queries you may have.

Groww Customer Service

Groww offers customer support through email and chat. They also have a phone support option, but it is only available during business hours. Groww’s website also has a comprehensive FAQ section that covers a wide range of topics. Groww’s customer service is known for being responsive and helpful.

Comparison

When it comes to customer service, both Fyers and Groww offer similar options. However, Fyers has an edge over Groww in terms of phone support availability. Groww’s phone support is only available during business hours, which may not be convenient for all clients.

In terms of responsiveness, both brokers have a reputation for providing prompt and friendly customer service. So, you can expect to receive timely and helpful responses to your queries from either broker.

Overall, both Fyers and Groww offer good customer service and support. However, if you prefer having phone support available outside of business hours, Fyers may be your better option.

Research and Advisory

When it comes to investing, having access to reliable research and advisory services can make a big difference. Both Fyers and Groww offer research and advisory services to their clients, but there are some differences to keep in mind.

Fyers provides its customers with a range of research reports, including daily market updates, weekly reports, and monthly reports. These reports cover a range of topics, including market trends, sector analysis, and stock recommendations. In addition, Fyers also offers a “Fyers Thematic Basket” service, which allows investors to invest in a basket of stocks that are selected based on a specific theme or trend.

Groww also offers research and advisory services to its customers. The platform provides users with access to a range of research reports, including daily market updates, stock recommendations, and sector analysis. In addition, Groww also offers a “Smart Portfolio” service, which provides users with a personalized portfolio of stocks based on their investment goals and risk tolerance.

Both Fyers and Groww offer research and advisory services, but the level of detail and customization available can vary. If you like staying on top of market trends and want access to detailed research reports, Fyers may be your better option. On the other hand, if you are looking for a more personalized approach to investing, Groww’s Smart Portfolio service may be more up your alley.

Ultimately, the choice between Fyers and Groww will depend on your individual investment needs and preferences. It’s important to take the time to evaluate both platforms and their respective research and advisory services to determine which one is the best fit for you.

Advantages and Disadvantages

When comparing Fyers and Groww, it’s important to consider each platform’s advantages and disadvantages to determine which is best suited for your investment needs.

Advantages of Fyers

- Fyers offers investment options in Equity, F&O, Currency, and Commodities, providing a wider range of investment opportunities.

- Fyers has a lower brokerage fee, with a maximum of Rs. 20 per trade, making it more cost-effective for frequent traders.

- Fyers offers a margin funding facility, providing leverage to invest in stocks with a smaller capital.

- Fyers has a robust trading platform with advanced features and tools for technical analysis.

Disadvantages of Fyers

- Fyers does not offer investment in mutual funds, which is a popular investment option for many investors.

- Fyers has a limited presence in terms of physical branches and customer support, which may be a concern for some investors.

Advantages of Groww

- Groww has a user-friendly interface and is easy to use, making it a great option for Beginner investors.

- Groww offers investment options in Equity, F&O, and Currency, which covers most of the popular investment options.

- Groww offers investment in mutual funds, which is a popular investment option for many investors.

- Groww has a mobile app that allows investors to invest on the go.

Disadvantages of Groww

- Groww has a relatively higher brokerage fee, with a maximum of Rs. 20 per trade, which may not be cost-effective for frequent traders.

- Groww does not offer investment options in commodities, which may be a concern for investors interested in diversifying their portfolio.

Overall, both Fyers and Groww have their unique advantages and disadvantages. It’s important to consider your investment needs and preferences before choosing a platform that suits you.

Conclusion

Now that you have compared Fyers and Groww, it’s time to make a decision based on your requirements and preferences. Here are some key takeaways to help you make an informed decision:

- Fyers offers investment options in Equity, F&O, Currency, and Commodities, while Groww only offers investment in Equity, F&O, and Currency.

- Fyers offers a zero brokerage charge for equity, whereas Groww charges Rs. 20 per executed order or 0.05% whichever is lower.

- Fyers charges Rs. 20 per executed order or 0.03% whichever is lower for intraday trading, whereas Groww charges Rs. 20 per executed order or 0.05% whichever is lower.

- Fyers provides a 30-day brokerage refund challenge, while Groww does not offer any such challenge.

If you are an active trader and looking for a broker with a lower brokerage charge, then Fyers could be a better option for you. However, if you are a beginner looking for a user-friendly platform with a simple interface, Groww could be a better choice.

It’s important to note that while comparing brokers, you should consider other factors such as customer support, trading platforms, research and analysis tools, etc. Ultimately, the decision depends on your personal preferences and requirements.

We hope that this comparison between Fyers and Groww has helped you make a more informed decision. Happy trading!

Frequently Asked Questions

How does Fyers compare to Groww?

Fyers and Groww are online discount brokers offering investment in Equity, F&O, Currency, and Commodities. However, Fyers offers a brokerage charge of Rs.0 for equity and Rs.20 per executed order for intraday trading, while Groww charges a flat fee of Rs.20 or 0.05% per executed order, whichever is lower. Additionally, Fyers is a member of the CDSL depository, while Groww is not.

What are the differences between Fyers and Groww?

The main differences between Fyers and Groww are their brokerage charges and depository membership. Fyers offers a brokerage charge of Rs.0 for equity and Rs.20 per executed order for intraday trading, while Groww charges a flat fee of Rs.20 or 0.05% per executed order, whichever is lower. Fyers is also a member of the CDSL depository, while Groww is not.

Which app offers better features, Fyers or Groww?

The features offered by Fyers and Groww are quite similar. Both apps offer investment in Equity, F&O, Currency, and Commodities. However, Fyers offers a more user-friendly trading platform with advanced charting features, while Groww has a simpler interface that is more suitable for beginners.

What are the pros and cons of using Fyers instead of Groww?

The pros of using Fyers include zero brokerage charges for equity and advanced charting features. The cons include a lack of research tools and a slightly complicated account opening process. On the other hand, the pros of using Groww include a simple interface, a low flat fee for trading, and a quick account opening process. The cons include a lack of advanced charting features and research tools.

Can Fyers be considered a safe platform for trading?

Yes, Fyers can be considered a safe platform for trading. It is a registered member of the CDSL depository and follows all SEBI regulations.

Is it true that Fyers offers lower AMC charges compared to other platforms?

Yes, Fyers offers lower AMC charges compared to other platforms. It charges an AMC fee of Rs.0 for its demat account, which is free of cost.

What are direct mutual funds, and can I invest in them through Fyers and Groww?

Direct mutual funds are investment schemes where investors can buy units directly from the asset management company (AMC) without involving any intermediaries like brokers or distributors. Both Fyers and Groww allow investors to invest in direct mutual funds.

What are the account opening charges for Fyers and Groww platforms?

Fyers and Groww are both demat accounts that provide free accounts, and it is advisable to check their respective websites or contact customer support for the latest information.

How do Fyers and Groww platforms facilitate trading in the stock market?

Fyers and Groww platforms provide easy access to the stock market, allowing investors to buy and sell stocks of various companies listed on Indian stock exchanges.

Is there an account opening fee for using Fyers and Groww platforms?

Yes, there might be an account opening fee for using Fyers and Groww platforms. Investors should review their fee structures to understand the charges associated with account opening.

Which platform offers the best trading app experience – Fyers or Groww?

The best trading app experience between Fyers and Groww depends on individual preferences. Investors can explore both platforms and choose the one that offers user-friendly features, real-time data, and a smooth trading experience.

How can I use a brokerage calculator on Fyers and Groww platforms?

Fyers and Groww offer brokerage calculators that help investors estimate the brokerage charges and related costs for their trades. Users can input trade parameters like quantity, price, and segment to calculate the charges associated with their transactions.