Sharekhan vs Angel One: Which Is The Best For You?

In this post, I’m going to compare Sharekhan and Angel One.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Sharekhan vs Angel One in terms of:

- Overview

- Account Opening and Maintenance charges

- Brokerage Charges

- Trading Platform

Let’s get started.

Sharekhan vs Angel One: Summary

| Sharekhan | Angel One | |

|---|---|---|

| Type | Full-Service Broker | Full-Service Broker |

| Year Founded | 2000 | 1987 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 3.8 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.10% or Rs. 20 per executed order, whichever is lower | 0.03% or Rs 20 per order, whichever is lower |

| Maximum Brokerage per Executable Order | No | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | No |

| Presence in Branches | More than 5 50 branches | More than 110 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | N/A |

| Ranking | 9th | 6th |

Sharekhan: An Overview

If you’re looking for a friendly and reliable broker for your trading needs, Sharekhan could be the perfect choice for you. Sharekhan is a full-service broker offering a wide range of trading services for beginners and experienced traders.

One of the best things about Sharekhan is its Easy account opening process. You can open an account with Sharekhan in just a few simple steps and start trading within a few hours. Sharekhan offers trading in equities, derivatives, commodities, and currencies on BSE, NSE, and MCX.

Sharekhan offers a range of services to help you make informed trading decisions. It has a dedicated research team that provides research reports, market analysis, and trading tips to help you stay ahead of the curve. Sharekhan also offers trading tools like TradeTiger, a powerful trading platform that gives you access to real-time market data and advanced charting tools.

When it comes to brokerage charges, Sharekhan charges 0.50% for equity delivery and 0.10% for equity intraday trading. Sharekhan also offers a range of brokerage plans to suit your trading needs.

Overall, Sharekhan is a great choice for anyone looking for a friendly and reliable broker that offers a range of trading services and tools.

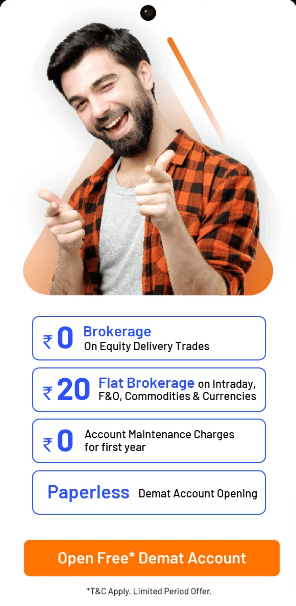

Angel One: An Overview

If you’re looking for a Best broker offering a range of trading services, then Angel One might be the right choice. Founded in 1987, Angel One is a SEBI-registered broker that offers investment in Equity, F&O, Currency, and Commodities. With 900 branches across India, Angel One provides you with easy access to its services.

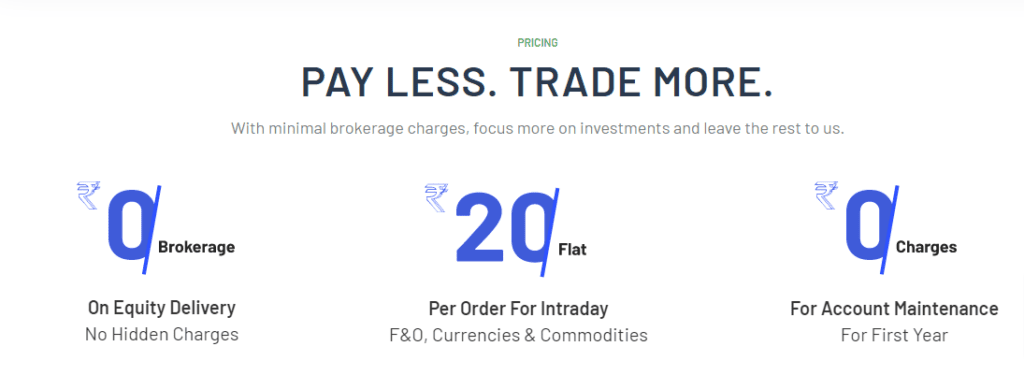

One of the key benefits of Angel One is its low brokerage fees. The brokerage of Angel One ranges between Rs 20, which is much lower than the traditional percentage-based brokerage offered by other brokers. This makes it an ideal choice for traders who are looking to minimize their trading costs.

Another advantage of Angel One is its range of trading services. You can trade on BSE, NSE, MCX, and NCDEX, giving you access to various investment options. Whether you’re interested in stocks, commodities, or currencies, Angel One has got you covered.

When it comes to account opening, Angel One charges a fee of Rs 600, which is higher than some other brokers. However, it offers a range of services that make it worth the investment. For example, you get access to a dedicated relationship manager who can help you with your trading needs.

Overall, Angel One is a great choice for traders looking for a discount broker offering a range of trading services. With its low brokerage fees and Long Term investment options, Angel One is an excellent choice for anyone wanting to start trading.

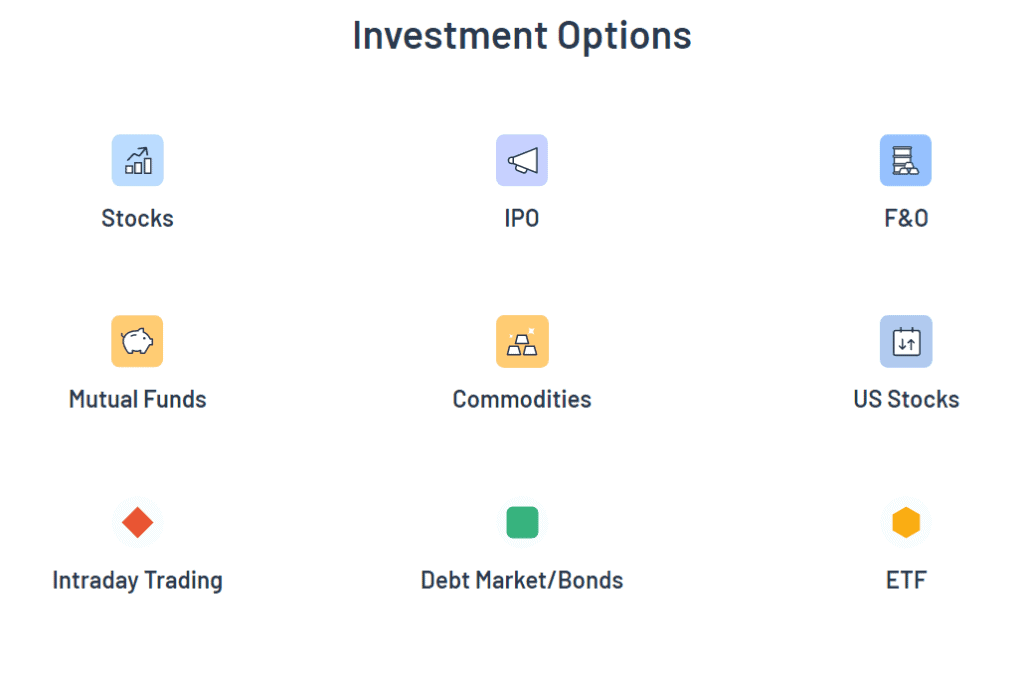

Investment Options

When it comes to investing, Sharekhan and Angel One offer a range of options to choose from. Here are the different investment options available with these brokers:

Equity

Both Sharekhan and Angel One allow you to invest in equity. Sharekhan charges a brokerage of 0.50% for equity, while Angel One offers free brokerage for equity investments.

Intraday

If you’re interested in intraday trading, Sharekhan charges a brokerage of 0.10%, while Angel One charges a flat fee of Rs 20 per executed order.

Equity Delivery

Sharekhan charges a brokerage of 0.50% for equity delivery, while Angel One offers free brokerage for equity investments.

Demat Account

Both brokers offer Demat account services. Angel One charges an annual maintenance fee (AMC) of Rs 240, while Sharekhan charges an AMC of Rs 400 (free for the first year).

IPO

If you’re interested in investing in IPOs, both Sharekhan and Angel One offer this service. However, the charges may vary depending on the IPO.

F&O

Both Sharekhan and Angel One offer futures and options trading. Sharekhan charges a brokerage of 0.05% for futures and Rs 50 per lot for options, while Angel One charges a brokerage of Rs 20 per executed order for both futures and options.

Currency

Sharekhan and Angel One offer this service if you’re interested in currency trading. Sharekhan charges a brokerage of 0.05%, while Angel One charges a flat fee of Rs 20 per executed order.

Mutual Fund

Both brokers offer mutual fund investments. Sharekhan charges a brokerage of 0.50%, while Angel One offers free brokerage for mutual fund investments.

Overall, both Sharekhan and Angel One offer a range of investment options to choose from. Depending on your investment goals and preferences, you can choose the best broker that suits your needs.

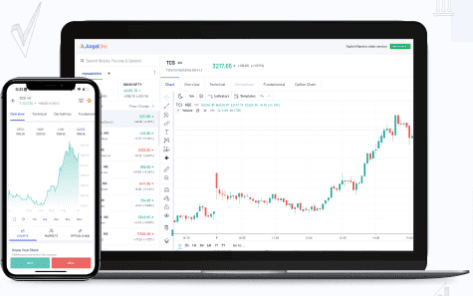

Trading Platforms

When it comes to trading platforms, both Sharekhan and Angel One offer a range of options to suit different trading styles and preferences. Here’s a breakdown of the different platforms available:

Mobile

Both Sharekhan and Angel One offer mobile trading apps that allow you to trade on the go. Sharekhan’s app is called Sharekhan App, while Angel One’s app is called Angel One. Both apps are available for iOS and Android devices.

They offer features such as real-time streaming quotes, market news, and research reports. However, users have reported that Sharekhan’s app is more user-friendly and intuitive compared to Angel One’s app.

Web

Sharekhan offers a web-based trading platform called Sharekhan TradeTiger, while Angel One offers Angel One Trade.

Both platforms offer features such as live streaming quotes, advanced charting tools, and research reports. However, Sharekhan’s TradeTiger is known for its speed and reliability, making it a popular choice among active traders.

Desktop

For those who prefer a more traditional trading platform, Sharekhan offers Sharekhan Desktop Trading Software, while Angel One offers Angel One SpeedPro.

Both platforms offer advanced charting tools, real-time streaming quotes, and customizable layouts. However, Sharekhan’s Desktop Trading Software is known for its speed and reliability, making it a popular choice among active traders.

API

Sharekhan and Angel One offer APIs (Application Programming Interfaces) for developers and advanced traders, allowing you to build your own trading applications and algorithms. Sharekhan offers Sharekhan API, while Angel One offers Angel One API. Both APIs offer features such as real-time streaming quotes, order management, and market data. However, Sharekhan’s API is known for its ease of use and Documentation, making it a popular choice among developers.

Both Sharekhan and Angel One offer a range of trading platforms to suit different trading styles and preferences. Whether you prefer to trade on your mobile device, web browser, desktop, or through an API, both brokers have you covered.

Brokerage and Charges

When it comes to choosing a stockbroker, one of the most important factors to consider is the brokerage and charges. In this section, we will compare Sharekhan and Angel One in terms of their brokerage and charges.

Brokerage

Sharekhan charges a brokerage fee of 0.50% for equity delivery and 0.10% for intraday trading. On the other hand, Angel One offers free equity delivery trading and charges Rs 20 per executed order for intraday trading.

| Broker | Equity Delivery | Equity Intraday | Futures | Options |

|---|---|---|---|---|

| Sharekhan | 0.50% | 0.10% | Rs 190 per crore | Rs 5000 per crore |

| Angel One | Free | Rs 20 per executed order | Rs 190 per crore | Rs 5000 per crore |

AMC

Sharekhan’s Demat Account AMC Charge is Rs 400 (Free for the first year), while Angel One’s Demat Account AMC Charge is Rs 240.

| Broker | Account Opening Charges | Demat Account AMC Charges |

|---|---|---|

| Sharekhan | Rs 0 | Rs 400 (Free for 1st year) |

| Angel One | Rs 0 | Rs 240 |

Transaction Charges

Both Sharekhan and Angel One charge transaction fees for trading. The stock exchanges and SEBI impose these fees. The transaction charges for both brokers are as follows:

| Broker | Equity Delivery | Equity Intraday | Futures | Options |

|---|---|---|---|---|

| Sharekhan | Rs 325 per crore | Rs 325 per crore | Rs 190 per crore | Rs 5000 per crore |

| Angel One | Rs 325 per crore | Rs 325 per crore | Rs 190 per crore | Rs 5000 per crore |

Other Charges

Apart from the brokerage and transaction charges, there are other charges that you should be aware of. These include minimum brokerage, call and trade charges, and SMS alert charges. Here is a comparison of Sharekhan and Angel One’s other charges:

| Broker | Minimum Brokerage | Call and Trade Charges | SMS Alerts Charges |

|---|---|---|---|

| Sharekhan | 5 paise per share | Free | Free |

| Angel One | Rs 20 per executed order | Rs 20 per call | Free |

In summary, while Sharekhan charges a higher brokerage fee for equity delivery and intraday trading, Angel One offers free equity delivery trading and charges a flat fee of Rs 20 per executed order for intraday trading. When it comes to transaction charges and other charges, both brokers are fairly similar.

Comparison of Services

When it comes to comparing Sharekhan and Angel One, it’s important to look at the services offered by both brokers. Here is a breakdown of the services offered by both brokers:

Equity Intraday

Both Sharekhan and Angel One offer equity intraday trading. Sharekhan charges a brokerage fee of 0.10%, while Angel One charges a flat fee of Rs. 20 per trade.

Equity Options

Sharekhan and Angel One both offer equity options trading. Sharekhan charges a brokerage fee of 0.50%, while Angel One charges a flat fee of Rs. 20 per trade.

Equity Futures

Sharekhan and Angel One both offer equity futures trading. Sharekhan charges a brokerage fee of 0.1-0.5%, while Angel One charges a flat fee of Rs. 20 per trade.

Currency Futures

Both Sharekhan and Angel One offer currency futures trading. Sharekhan charges a brokerage fee of 0.1-0.5%, while Angel One charges a flat fee of Rs. 20 per trade.

Currency Options

Sharekhan and Angel One both offer currency options trading. Sharekhan charges a brokerage fee of 0.1-0.5%, while Angel One charges a flat fee of Rs. 20 per trade.

Commodity Futures

Both Sharekhan and Angel One offer commodity futures trading. Sharekhan charges a brokerage fee of 0.1-0.5%, while Angel One charges a flat fee of Rs. 20 per trade.

Commodity Options

Sharekhan and Angel One both offer commodity options trading. Sharekhan charges a brokerage fee of 0.1-0.5%, while Angel One charges a flat fee of Rs. 20 per trade.

Intraday Trading

Both Sharekhan and Angel One offer Intraday trading. Sharekhan charges a brokerage fee of 0.1-0.5%, while Angel One charges a flat fee of Rs. 20 per trade.

Both Sharekhan and Angel One offer similar services with slight differences in brokerage fees. Depending on your trading preferences, you may find one broker more suitable for your needs than the other.

Special Offers and Features

When it comes to special offers and features, both Sharekhan and Angel One have their own set of advantages.

Sharekhan Offers

Sharekhan offers a range of special offers to its clients. Some of the key features and offers include:

- Zero Account Opening Charges: Sharekhan offers zero account opening charges for all its clients. This is a great way to start your investment journey without any extra costs.

- Research and Advisory Services: Sharekhan provides its clients with research and advisory services to help them make informed investment decisions. This includes fundamental and technical research reports, market updates, and investment ideas.

- Multiple Trading Platforms: Sharekhan offers multiple trading platforms, including Sharekhan TradeTiger, Sharekhan Mini, and Sharekhan App. This gives you the flexibility to trade on the go, from anywhere, and at any time.

Angel One Offers

Angel One also offers its clients a range of special offers and features. Some of the key features and offers include:

- Angel iTrade Prime: Angel iTrade Prime is a premium Trading account that offers a range of benefits to its clients. This includes free trading in Equity Delivery, priority customer service, and access to exclusive research reports.

- Low Brokerage Charges: Angel One offers low brokerage charges to its clients, making it an attractive option for those who are looking to save on brokerage fees.

- Multiple Trading Platforms: Angel One offers multiple trading platforms, including Angel One App, Angel SpeedPro, and Angel BEE. This gives you the flexibility to choose the platform that suits your trading needs.

In conclusion, Sharekhan and Angel One offer their clients a range of special offers and features. Evaluating these offers and features based on your investment needs and preferences is important to make an informed decision.

Reviews and Ratings

When it comes to choosing between Sharekhan and Angel One, it’s important to consider what other customers have to say about their experiences with each broker. Here are some reviews and ratings from real customers to help you make an informed decision:

Sharekhan has an overall rating of 3.8 stars out of 5, with many customers praising the broker’s customer service and user-friendly platform. However, some customers have noted that Sharekhan’s fees can be high compared to other brokers.

Angel One has an overall rating of 4.2 stars out of 5 on Google Reviews, with many customers appreciating the broker’s low fees and easy-to-use app. However, some customers have reported issues with the platform’s stability and customer service.

Overall, both Sharekhan and Angel One have received generally positive reviews from customers. When choosing between these two brokers, it’s important to consider your own priorities and needs as an investor.

Support and Customer Service

When it comes to supporting and customer service, both Sharekhan and Angel One are known for providing prompt and friendly assistance to their clients.

Sharekhan has a dedicated customer service team that can be reached through phone, email, or live chat. They also have a comprehensive FAQ section on the Sharekhan Website that covers a wide range of topics related to trading and investing. Additionally, Sharekhan has a network of over 2800 branches across India, which means that clients can also visit their local Sharekhan branch for assistance.

Angel One also has a customer service team that can be reached through phone, email, or live chat. Angel One website also has a chatbot feature that can help answer basic queries. Angel One has a network of over 900 branches across India, which means that clients can visit their local Angel One branch for assistance as well.

Both Sharekhan and Angel One have mobile apps that allow clients to access their accounts and trade on the go. The apps are user-friendly and have a range of features that make trading and investing easy and convenient.

In terms of support and customer service, both Sharekhan and Angel One are reliable and responsive. They have a range of channels through which clients can seek assistance, and their customer service teams are known for being friendly and helpful.

Pros and Cons

When it comes to choosing between Sharekhan and Angel One, there are several pros and cons to consider. Here are some of the key advantages and disadvantages of each platform:

Sharekhan Pros

- Wide range of investment options: Sharekhan offers a wide variety of investment options, including stocks, mutual funds, IPOs, bonds, and more. This makes it a great choice for investors who want to diversify their portfolios.

- Excellent research and analysis tools: Sharekhan’s research and analysis tools are some of the best in the industry. The platform offers a range of tools and resources for investors, including stock screeners, market news, and expert analysis.

- Strong customer support: Sharekhan has a strong customer support team available to assist you with any questions or concerns. You can reach out to the company via phone, email, or live chat.

Sharekhan Cons

- High brokerage fees: Sharekhan’s brokerage fees are higher than other brokers in the market. This may be a disadvantage for investors who are looking to minimize their trading costs.

- Limited branch network: While Sharekhan has a large number of branches across India, its network is still limited compared to some other brokers. This may be a disadvantage for investors who prefer to work with a broker that has a strong physical presence in their area.

Angel One Pros

- Low brokerage fees: Angel One’s brokerage fees are some of the lowest in the industry, making it a great choice for investors who want to keep their trading costs low.

- Wide branch network: Angel One has a wide network of branches across India, making it easy for investors to access its services no matter where they are located.

- Good trading platform: Angel One’s trading platform is easy to use and offers investors a range of features and tools.

Angel One Cons

- Limited investment options: Angel One’s investment options are somewhat limited compared to some other brokers. The platform primarily focuses on stocks and derivatives, so it may not be the best choice for investors who want to diversify their portfolios.

- Limited research and analysis tools: While Angel One offers some research and analysis tools, they are not as extensive as those offered by other brokers. This may be a disadvantage for investors who rely heavily on research and analysis to make investment decisions.

Overall, both Sharekhan and Angel One have their pros and cons. It’s important to carefully consider your investment goals and preferences before choosing a platform to work with.

Conclusion

Choosing between Sharekhan and Angel One can be tough, but hopefully, this comparison has helped you make an informed choice. Both brokers are registered with SEBI and offer investment in Equity, F&O, Currency, and Commodities. However, there are some differences between them that you should consider.

If you are looking for a full-service broker with a wide range of products and services, Sharekhan could be your choice. With over 2800 branches across India, Sharekhan offers a personalized experience with dedicated relationship managers who can help you with your investment decisions. They also offer a variety of banking services and products, including a 3-in-1 account that allows you to seamlessly Transfer funds between your trading account, savings account, and demat account.

On the other hand, if you are looking for a discount broker with a simple and easy-to-use platform, Angel One could be the right choice for you. With a flat brokerage fee starting at Rs 20, Angel One offers a cost-effective way to trade in the stock market. They also offer a range of order types, including market orders, limit orders, and stop-loss orders, as well as exposure to help you maximize your profits.

If you are a Beginner, you might find Angel One’s platform easier to use than Sharekhan’s TradeTiger, which is more suited for experienced traders. However, if you are an experienced trader, you might prefer TradeTiger’s advanced features and tools.

Both Sharekhan and Angel One have their strengths and weaknesses, and the choice between them depends on your individual preferences and investment goals. We recommend that you do your research, compare the features and pricing of both brokers and make an informed decision based on your needs.

Frequently Asked Questions

Which is better for trading, Sharekhan or Angel One?

Both Sharekhan and Angel One are good options for trading. Sharekhan is a full-service broker, while Angel One is a discount broker. Sharekhan offers a wide range of investment options and has a large number of branches across India. On the other hand, Angel One has a simple and user-friendly platform and offers lower brokerage rates.

What are the differences between Angel One and Angel One?

Angel One and Angel One are two different companies. Angel One is a full-service broker, while Angel One is a discount broker. Angel One offers a wide range of investment options and has a large number of branches across India. On the other hand, Angel One has a simple and user-friendly platform and offers lower brokerage rates.

Is Angel One a good option for trading?

Yes, Angel One is a good option for trading. It offers a simple and user-friendly platform with lower brokerage rates than other full-service brokers.

Can you compare the brokerage rates of Sharekhan and Angel One?

Yes, we can compare the brokerage rates of Sharekhan and Angel One. Sharekhan’s brokerage rates range from 0.1% to 0.5%, while Angel One’s brokerage rates start at Rs 20 per trade. Depending on your trading volume, one of these options may be more cost-effective for you.

What are the drawbacks of using Angel One?

Angel One is a full-service broker with higher brokerage rates than discount brokers like Angel One. Additionally, Angel One has a large number of branches across India, which may make it difficult to get personalized attention from your broker.

Sharekhan Espresso vs Zerodha: Which is the better option?

Sharekhan Espresso and Zerodha are two different trading platforms. Sharekhan Espresso is a mobile trading app offered by Sharekhan, while Zerodha is a discount broker with a web-based trading platform. Depending on your trading style and preferences, one of these options may be better suited for you.