Zerodha vs Upstox vs Groww vs Angel One

In this post, I’m going to compare four Brokers Zerodha, Upstox, Groww, and Angel One.

So if you’re looking for a deep comparison of these four popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Zerodha vs Upstox vs Groww vs Angel One in terms of:

- Overview

- Account Opening

- Brokerage Charges

- Trading Platform

- Service and Support

- Investment Options

- Margin and Leverage

- Research and Education

Let’s get started.

Zerodha vs Upstox vs Groww vs Angel One: Summary

| Zerodha | Upstox | Groww | Angel One | |

|---|---|---|---|---|

| Type | Discount Broker | Discount Broker | Online Investment Platform | Full-Service Broker |

| Year Founded | 2010 | 2011 | 2017 | 1987 |

| Headquarters | Bangalore, India | Mumbai, India | Bangalore, India | Mumbai, India |

| Overall Rating | 4.3 out of 5 | 4.5 out of 5 | 4 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Rs 20 or .01% per executed order | Lower of Rs 20 or 0.05% per executed trade | 0.03% or Rs 20 per order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 | N/A | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | No | Yes | No |

| Presence in Branches | More than 120 branches | More than 100 branches | No branches | More than 110 branches |

| Mobile Trading App | Available | Available | Available | Available |

| Number of Features | 60+ | 24+ | 20+ | N/A |

| Ranking | 1st | 2nd | 9th | 6th |

Zerodha Vs Upstox Vs Groww Vs Angel One: An Overview

If you’re new to investing, picking the right broker can be overwhelming. With so many options available, knowing which one is right for you can be difficult. This section gives you an overview of four popular brokers in India: Zerodha, Upstox, Groww, and Angel One.

Zerodha

Zerodha is one of the most popular discount brokers in India. They offer low brokerage fees, a user-friendly platform, and a range of investment options. Zerodha charges a flat fee of Rs. 20 per trade, regardless of the size of the trade. They also offer a range of educational resources, including webinars and online courses, to help you learn more about investing.

Upstox

Upstox is another popular discount broker in India. Like Zerodha, they offer low brokerage fees and a user-friendly platform. Upstox charges Rs. 20 or 0.05% per trade, whichever is lower. They also offer a range of investment options, including equities, derivatives, and commodities.

Groww

Groww is a newer player in the Indian brokerage industry. They offer a user-friendly mobile app that makes investing in mutual funds, stocks, and more easy. Groww charges zero brokerage fees for mutual fund investments and a flat fee of Rs. 20 per trade for equity investments. They also offer a range of educational resources, including articles and videos, to help you learn more about investing.

Angel One

Angel One is a full-service broker offering various investment options, including equities, derivatives, and commodities. They also offer research and advisory services to help you make informed investment decisions. Angel One charges higher brokerage fees than the discount brokers mentioned above, but they may be a good option for investors who want more personalized support.

Overall, each of these brokers has its own strengths and weaknesses. When choosing a broker, it’s important to consider your investment goals, trading style, and budget. With a little research, you’re sure to find a broker that’s right for you.

Account Opening

If you’re looking to open a trading account with any of the four brokers, you’ll need to complete their account opening process. Let’s take a look at the account opening process and features of each broker.

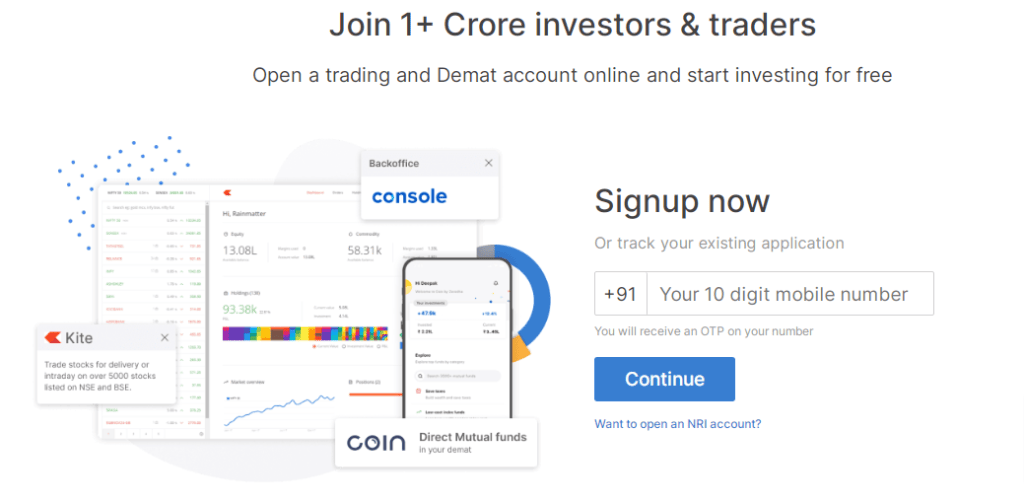

Zerodha Account Features

Zerodha offers a simple and easy account opening process. You can open a trading and demat account with Zerodha in a few simple steps. You can complete the account opening process online by visiting the Zerodha website or by using the Zerodha mobile app. The account opening process is completely paperless, and you can complete it within 15 minutes.

Zerodha offers two types of trading accounts: Equity and Commodity. The Equity account is used for trading in stocks, while the Commodity account is used for trading in commodities. You can also open a Demat account with Zerodha to hold your securities.

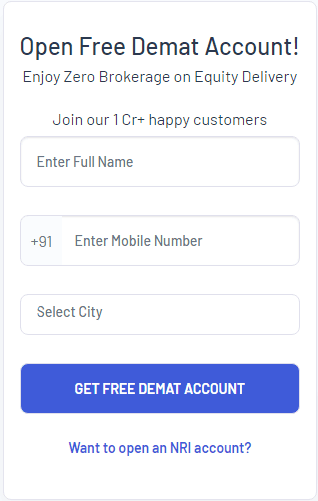

Upstox Account Features

Upstox offers a simple and easy account opening process. You can open a trading and demat account with Upstox in a few simple steps. You can complete the account opening process online by visiting the Upstox website or by using the Upstox mobile app. The account opening process is completely paperless, with your Documents, and you can complete it within 15 minutes.

Upstox offers two types of trading accounts: Equity and Commodity. The Equity account is used for trading in stocks, while the Commodity account is used for trading in commodities. You can also open a Demat account with Upstox to hold your securities.

Groww Account Features

Groww offers a simple and easy account opening process. You can open a trading and demat account with Groww in a few simple steps. You can complete the account opening process online by visiting the Groww website or by using the Groww mobile app. The account opening process is completely paperless, with your documents like PAN card, aadhar card. and you can complete it within 15 minutes.

Groww offers a single trading account that can be used for trading in stocks, mutual funds, and other securities. You can also open a Demat account with Groww to hold your securities.

Angel One Account Features

Angel One offers a simple and easy account opening process. You can open a trading and demat account with Angel One in a few simple steps. You can complete the account opening process online by visiting the Angel One website or by using the Angel One mobile app. The account opening process is completely paperless, and you can complete it within 15 minutes.

Angel One offers three types of Trading accounts: Equity, Commodity, and Currency. The Equity account is used for trading in stocks, while the Commodity account is used for trading in commodities. The Currency account is used for trading in currency derivatives. You can also open a Demat account with Angel One to hold your securities.

Overall, all four brokers offer a simple and easy account opening process that can be completed within 15 minutes. Zerodha, Upstox, and Groww offer a single trading account, while Angel One offers three types of trading accounts. You can also open a Demat account with all four brokers to hold your securities.

Brokerage and Charges

When it comes to choosing a broker, one of the most important factors to consider is brokerage and charges. This section will compare the brokerage and charges of Zerodha, Upstox, Groww, and Angel One.

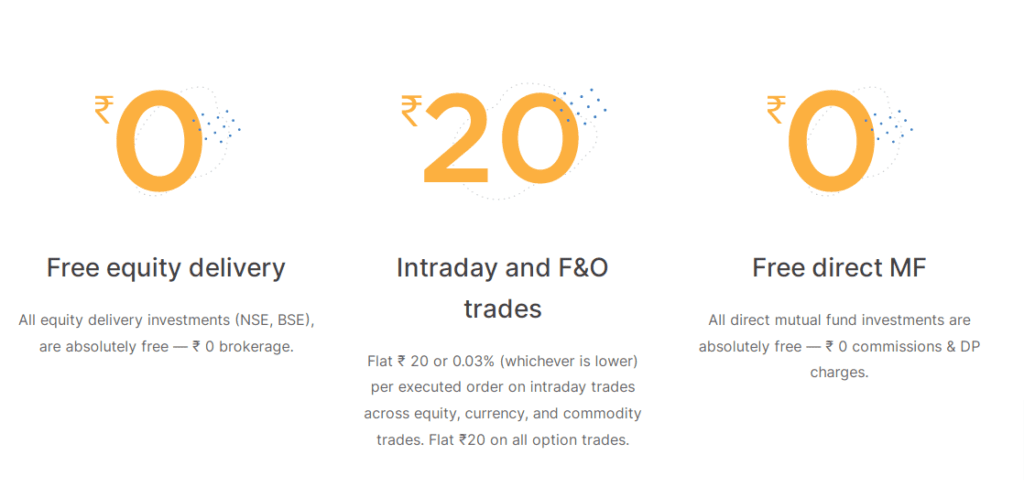

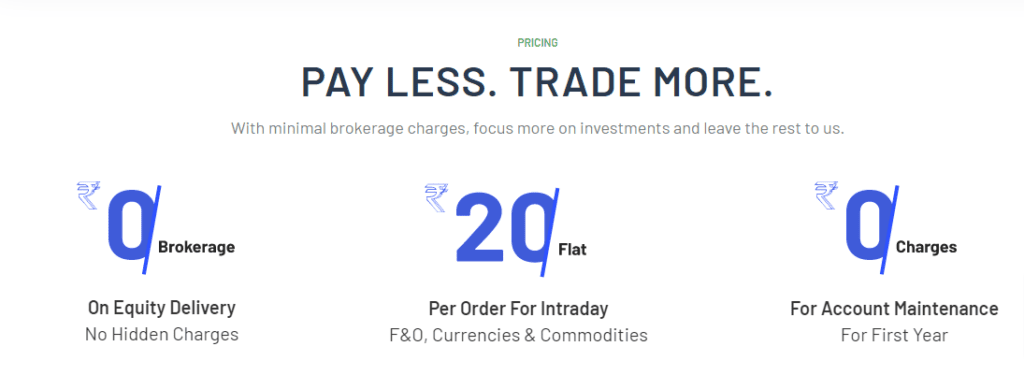

Zerodha Brokerage and Charges

It is a discount broker that Zerodha charges a flat fee of Rs. 20 per trade, irrespective of the size of the trade. They do not charge any minimum brokerage or hidden charges. However, they charge transaction charges, which vary depending on the exchange and segment. Zerodha also charges a maintenance fee of Rs. 300 per year and Rs. 200 for the Demat account opening charges.

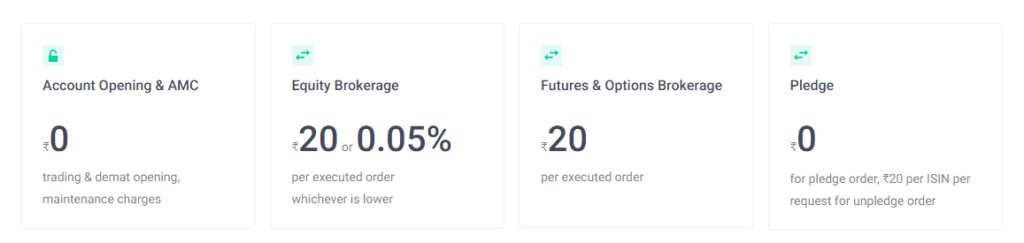

Upstox Brokerage and Charges

Upstox is another discount broker that charges a flat fee of Rs. 20 per trade. They also do not charge any minimum brokerage or hidden charges. However, they do charge transaction charges, which vary depending on the exchange and segment. Upstox charges a maintenance fee of Rs. 150 per year for the demat account.

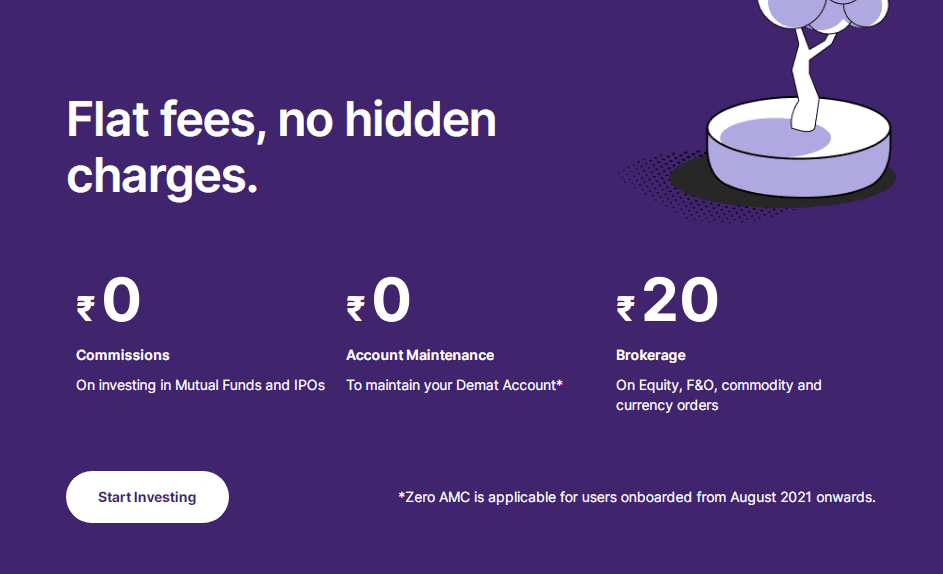

Groww Brokerage and Charges

Groww is a broker that offers commission-free trading. They do charge Rs. 20 for delivery trades for Intraday and F&O trades. They charge a flat fee of Rs. 20 per trade. Groww does not charge any minimum brokerage or hidden charges. However, they do charge transaction charges, which vary depending on the exchange and segment. Groww also does not charge any maintenance fee for the trading or demat account.

Angel One Brokerage and Charges

Angel One is a full-service broker that charges a percentage-based brokerage ranging from 0.03% to 0.5%. They also charge a minimum brokerage of Rs. 20 per trade. Angel One does not charge hidden charges, but they charge transaction charges, which vary depending on the exchange and segment. They also charge a maintenance fee of Rs. 450 per year for the trading account and Rs. 300 per year for the demat account.

To summarize the brokerage and charges of Zerodha, Upstox, Groww, and Angel One, we have created a table below:

| Broker | Brokerage | Minimum Brokerage | Hidden Charges | Transaction Charges | Maintenance Charges |

|---|---|---|---|---|---|

| Zerodha | Rs. 20 per trade | None | None | Varies by exchange and segment | Rs. 150 per year for a demat account |

| Upstox | Rs. 20 per trade | None | None | Varies by exchange and segment | Rs. 240 per year for a demat account |

| Groww | Rs. 20 for delivery trades and Rs. 20 per trade for intraday and F&O trades | None | None | Varies by exchange and segment | None |

| Angel One | 0.03% to 0.5% | Rs. 20 per trade | None | Varies by exchange and segment | Rs. 240 per year for demat account |

As you can see from the table above, each broker has its own unique fee structure. It is important to carefully consider these fees before choosing a broker to ensure that you are getting the best value for your money.

Trading Platforms

When it comes to trading platforms, Zerodha, Upstox, Groww, and Angel One offer unique features to cater to different trading styles and preferences. Here’s a breakdown of each platform:

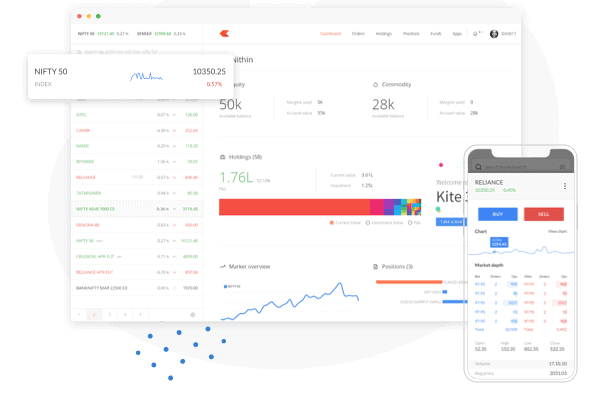

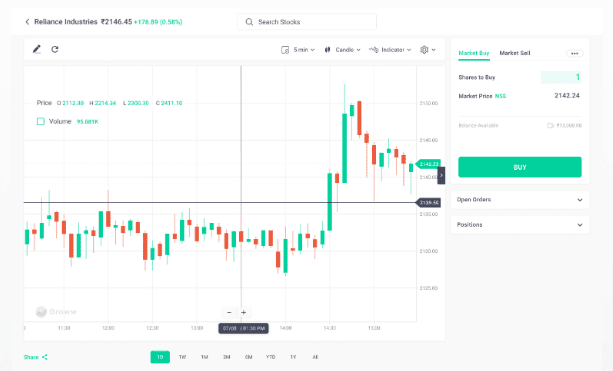

Zerodha Trading Platform

Zerodha’s trading platform, Kite, is known for its user-friendly interface and intuitive design. Kite offers advanced charting tools, real-time data, and a range of order types. You can also customize your workspace and create your own watchlists. Kite is available on both desktop and mobile, making it easy to trade on the go.

Upstox Trading Platform

Upstox’s trading platform is also available on desktop and mobile. The platform offers a range of features, including advanced charting tools, real-time data, and a customizable workspace. Upstox also offers a range of order types, including bracket orders and cover orders. The platform is known for its fast execution speeds and low latency.

Groww Trading Platform

Groww’s trading platform is designed for Beginners and offers a simple, easy-to-use interface. The platform offers real-time data and various order types, including market and limit orders. Groww’s mobile app is also user-friendly and allows you to trade on the go. However, the platform lacks advanced charting tools and customization options.

Angel One Trading Platform

Angel One’s trading platform is a full-service platform offering various features, including advanced charting tools, real-time data, and a customizable workspace. The platform also offers a range of order types, including bracket orders and cover orders. Angel One’s mobile app is also user-friendly and allows you to trade on the go. However, the platform’s brokerage fees are higher compared to discount brokers like Zerodha and Upstox.

Each platform offers unique features and caters to different trading styles and preferences. Choosing a platform that aligns with your trading goals and needs is important. Whether you prefer a user-friendly interface or advanced charting tools, a trading platform exists for you.

Services and Support

Zerodha Services and Support

Zerodha offers its customers a wide range of services, including trading and investment services. The company has a user-friendly trading platform that is easy to use and navigate. Zerodha also provides its customers with a range of educational resources, including webinars, articles, and tutorials, to help them learn more about trading and investing.

When it comes to customer support, Zerodha offers a range of options, including phone support, email support, and live chat. The company also has a comprehensive knowledge base that covers a wide range of topics related to trading and investing. If you need help with anything, you can easily find answers to your questions in the knowledge base.

Upstox Services and Support

Upstox offers a range of services to its customers, including trading services, investment services, and more. The company has a user-friendly trading platform that is easy to use and navigate. Upstox also provides its customers with a range of educational resources, including webinars, articles, and tutorials, to help them learn more about trading and investing.

When it comes to customer support, Upstox offers a range of options, including phone support, email support, and live chat. The company also has a comprehensive knowledge base that covers a wide range of topics related to trading and investing. If you need help with anything, you can easily find answers to your questions in the knowledge base.

Groww Services and Support

Groww offers a range of services to its customers, including trading services, investment services, and more. The company has a user-friendly trading platform that is easy to use and navigate. Groww also provides its customers with a range of educational resources, including webinars, articles, and tutorials, to help them learn more about trading and investing.

When it comes to customer support, Groww offers a range of options, including phone support, email support, and live chat. The company also has a comprehensive knowledge base that covers a wide range of topics related to trading and investing. If you need help with anything, you can easily find answers to your questions in the knowledge base.

Angel One Services and Support

Angel One offers a range of services to its customers, including trading services, investment services, and more. The company has a user-friendly trading platform that is easy to use and navigate. Angel One also provides its customers with a range of educational resources, including webinars, articles, and tutorials, to help them learn more about trading and investing.

When it comes to customer support, Angel One offers a range of options, including phone support, email support, and live chat. The company also has a comprehensive knowledge base that covers a wide range of topics related to trading and investing. If you need help with anything, you can easily find answers to your questions in the knowledge base.

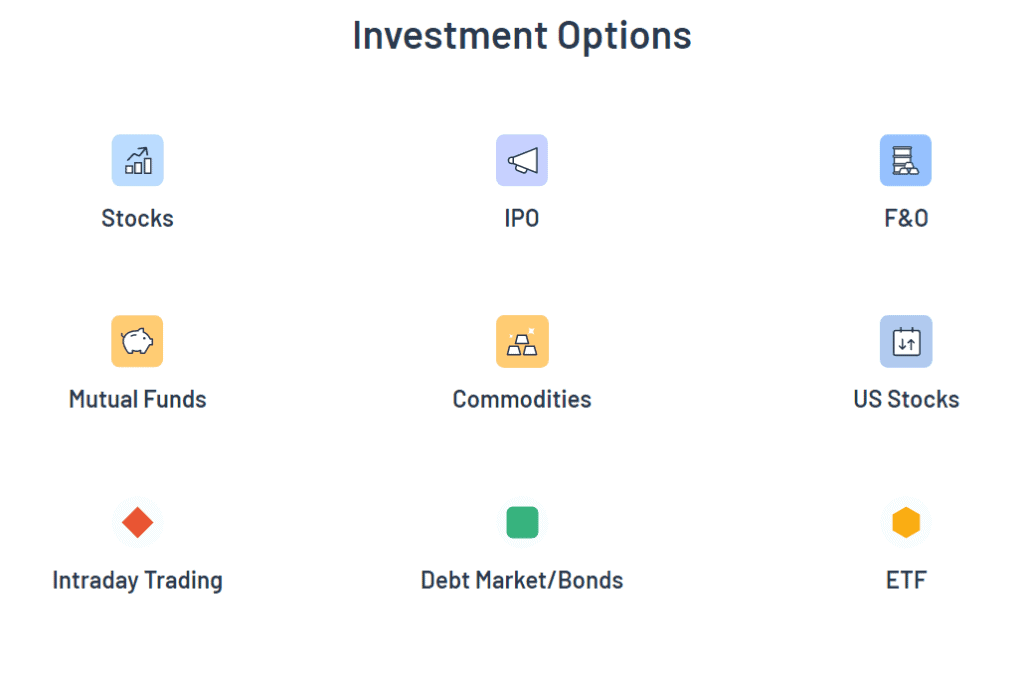

Investment Options

When it comes to investment options, Zerodha, Upstox, Groww, and Angel One offer a range of choices to suit different investment needs. Here’s a breakdown of the investment options available on each platform.

Zerodha Investment Options

Zerodha offers a wide range of investment options, including mutual funds, derivatives, commodities, currency, equity, IPO, and more. You can trade in equity futures, equity intraday, equity delivery trading, equity options, and commodity trading. The platform also offers direct mutual funds, making investing in mutual funds online easier. Zerodha also offers investment options in digital gold, which is a convenient way to invest in gold without having to store it physically.

Upstox Investment Options

Upstox offers a range of investment options, including equity, derivatives, currency, and commodity trading. You can trade in equity futures, equity intraday, equity delivery trading, equity options, and commodity trading. The platform also offers direct mutual funds, making investing in mutual funds online easier. Upstox also offers investment options in digital gold, which is a convenient way to invest in gold without having to store it physically.

Groww Investment Options

Groww offers a range of investment options, including mutual funds, equity, and digital gold. The platform allows you to easily invest in online mutual fund investment, making it easier to grow your wealth. You can also invest in SIPs (Systematic Investment Plans), which are a great way to invest in mutual funds regularly and systematically. Groww also offers investment options in digital gold, which is a convenient way to invest in gold without having to store it physically.

Angel One Investment Options

Angel One offers a range of investment options, including equity, derivatives, currency, and commodity trading. You can trade in equity futures, equity intraday, equity delivery trading, equity options, and commodity trading. The platform also offers direct mutual funds, making investing in mutual funds online easier. Angel One also offers investment options in digital gold, which is a convenient way to invest in gold without having to store it physically.

In summary, each of these platforms offers a range of investment options to suit different investment needs. An investment option is available if you’re looking to invest in mutual funds, derivatives, or digital gold.

Margin and Leverage

When it comes to trading, margin, and leverage are two important concepts that can help you maximize your profits. Here’s a breakdown of the margin and leverage offered by Zerodha, Upstox, Groww, and Angel One.

Zerodha Margin and Leverage

Zerodha offers margin funding and margin trading facilities to its clients. The margin funding facility allows you to trade with funds borrowed from the broker, while the margin trading facility allows you to trade with funds that are a multiple of your available trading capital. Zerodha also offers leverage of up to 20 times for intraday trading.

Upstox Margin and Leverage

Upstox offers margin funding and margin trading facilities to its clients. The margin funding facility allows you to trade with funds borrowed from the broker, while the margin trading facility allows you to trade with funds that are a multiple of your available trading capital. Upstox also offers leverage of up to 20 times for intraday trading.

Groww Margin and Leverage

Groww does not offer margin funding or margin trading facilities to its clients. However, the broker offers leverage of up to 15 times for intraday trading.

Angel One Margin and Leverage

Angel One offers margin funding and margin trading facilities to its clients. The margin funding facility allows you to trade with funds borrowed from the broker, while the margin trading facility allows you to trade with funds that are a multiple of your available trading capital. Angel One also offers leverage of up to 20 times for intraday trading.

Overall, Zerodha, Upstox, and Angel One offer similar margin and leverage facilities, while Groww lags behind in this aspect. It’s important to note that while margin and leverage can help you maximize your profits, they can also increase your losses, so using them wisely is important.

Research and Education

When it comes to trading, it’s essential to have access to quality research and education materials to make informed decisions. Each of the four brokers offers different types of research and educational resources to help you stay up-to-date with market trends and make informed decisions.

Zerodha Research and Education

Zerodha offers a wide range of research and educational resources to help you make informed decisions. The broker’s flagship educational initiative is Zerodha Varsity, a comprehensive online stock market education portal. You can access Varsity for free and learn about everything from the stock market basics to advanced trading strategies. Additionally, Zerodha offers daily market reports, weekly newsletters, and a range of webinars.

Upstox Research and Education

Upstox provides a range of research and educational resources to help you make informed trading decisions. The broker offers daily market reports, weekly newsletters, and a range of webinars. Upstox also provides a comprehensive knowledge base covering everything from the basics of trading to advanced trading strategies. You can also access Upstox’s research reports to get insights into market trends and specific stocks.

Groww Research and Education

Groww provides a range of research and educational resources to help you make informed trading decisions. The broker offers daily market reports, weekly newsletters, and a range of webinars. Additionally, Groww provides a comprehensive knowledge base covering everything from trading basics to advanced trading strategies. You can also access Groww’s research reports to get insights into market trends and specific stocks.

Angel One Research and Education

Angel One offers a range of research and educational resources to help you make informed trading decisions. The broker provides daily market reports, weekly newsletters, and a range of webinars. Additionally, Angel One provides a comprehensive knowledge base covering everything from trading basics to advanced trading strategies. You can also access Angel One’s research reports to get insights into market trends and specific stocks.

In conclusion, each of the four brokers provides a range of research and educational resources to help you make informed trading decisions. Taking advantage of these resources is essential to stay up-to-date with market trends and make informed decisions.

Conclusion

After comparing Zerodha, Upstox, Groww, and Angel One, you may better know which one is the best fit for you. Each platform has its own strengths and weaknesses, so it’s important to consider what factors are most important to you.

If you’re looking for a discount broker with low brokerage fees, Zerodha and Upstox are both good options. Zerodha offers a wide range of investment options and has a user-friendly platform, while Upstox offers a mobile app that is easy to use and has a simple interface.

On the other hand, if you prefer a full-service broker with a range of investment options, Angel One may be the best choice for you. They offer a 3-in-1 account and a range of investment options, including mutual funds, IPOs, and bonds.

Groww is also a good option for those who are just starting out with investing. They offer a simple and easy-to-use platform and a range of investment options.

Ultimately, the choice between Zerodha, Upstox, Groww, and Angel One depends on your individual needs and preferences. Consider what factors are most important to you, such as brokerage fees, investment options, and user interface, and choose the platform that best fits your needs.

Frequently Asked Questions

Which brokerage platform has the lowest charges among Zerodha, Upstox, Groww, and Angel One?

All four platforms offer competitive brokerage charges. However, Zerodha and Upstox are discount brokers, which means they charge a flat fee per trade, while Groww and Angel One are full-service brokers, which means they charge a percentage of the transaction value. Overall, Zerodha and Upstox have the lowest charges.

What are the key differences between Zerodha, Upstox, Groww, and Angel One?

Zerodha and Upstox are discount brokers with a focus on technology and low-cost trading. Groww is a full-service broker that aims to simplify investing for beginners. Angel One is a full-service broker that offers a wide range of investment options, research, and advisory services. Each platform has its strengths and weaknesses; your choice will depend on your investment goals and preferences.

Which platform offers the best user experience between Zerodha, Upstox, Groww, and Angel One?

All four platforms offer user-friendly interfaces and mobile apps. Zerodha and Upstox have a more advanced trading platform with more features, while Groww and Angel One have a simpler interface that is easier to navigate. Ultimately, the best user experience depends on your preferences and trading style.

What are the unique features of Groww compared to Zerodha, Upstox, and Angel One?

Groww offers a unique feature called the “Smart Save” option, which allows you to earn higher interest rates on your savings while also providing instant liquidity. Groww also offers commission-free mutual fund investments, making it an attractive option for long-term investors. Zerodha and Upstox, on the other hand, offer advanced charting tools and trading algorithms that are not available on Groww or Angel One.

Which platform offers the best customer support between Zerodha, Upstox, Groww, and Angel One?

All four platforms offer customer support through various phone, email, and chat channels. Zerodha and Upstox have a large online community where users can share their experiences and get help from other users. Groww and Angel One offer personalized advisory services and dedicated relationship managers to help you with your investments. Overall, each platform has its strengths in terms of customer support.

Can you compare the research and analysis tools available on Zerodha, Upstox, Groww, and Angel One?

Zerodha and Upstox offer advanced research and analysis tools such as technical indicators, charting tools, and real-time data feeds. Groww and Angel One offer research reports, market insights, and personalized recommendations from their research teams. Each platform has its strengths in terms of research and analysis, and your choice will depend on your investment style and preferences.

Can I use a credit card to fund my trading account on Zerodha, Upstox, Groww, and Angel One?

Zerodha, Upstox, Groww, and Angel One did not support funding of trading accounts directly through credit cards. Typically, funding options include online banking, UPI, NEFT/RTGS, and other payment modes. It is advisable to check their respective websites or contact customer support for the latest funding options available.

Do Zerodha, Upstox, Groww, and Angel One offer NRI (Non-Resident Indian) trading services?

Yes, Zerodha, Upstox, Groww, and Angel One provide NRI trading services, allowing Non-Resident Indians to invest in the Indian stock market. Specific requirements and procedures can be found on their respective websites or by contacting their customer support.

How do Zerodha, Upstox, Groww, and Angel One compare as stockbrokers in terms of customer service?

Zerodha, Upstox, Groww, and Angel One all prioritize customer service and offer support through various channels, including phone, email, and chat. The quality of customer service may vary based on user experiences and support staff availability.

Which platform offers the best demat account services among Zerodha, Upstox, Groww, and Angel One?

The best demat account service depends on individual preferences, trading requirements, and the level of services needed. Each platform has its strengths and features. Investors can compare them based on factors like brokerage charges, user interface, research tools, and customer support to determine the most suitable option.

Can I trade in various options, such as equity options and currency options, on these platforms?

Yes, Zerodha, Upstox, Groww, and Angel One provide options trading facilities. Investors can trade in equity options, currency options, and other derivative contracts through their respective platforms.

How can I participate in Initial Public Offerings (IPOs) using Zerodha, Upstox, Groww, and Angel One accounts?

To participate in IPOs through these platforms, investors need to apply for the IPO through the UPI-based process. The IPO application feature is available on all these platforms, allowing investors to apply for new IPO issues directly through their accounts.