M Stock vs Zerodha: Comprehensive Comparison

When comparing M Stock vs Zerodha, it is important to delve into their offerings, features, and pricing structures to make an informed decision. In this comprehensive comparison and analysis, we will explore the strengths and weaknesses of these two popular discount brokers in India.

Key Takeaways:

- Zerodha is the largest stock broker in India, offering access to stocks, derivatives trading, and direct mutual fund investments.

- m.Stock, launched by Mirae Asset, is a new entrant in the Indian broking space with a unique zero brokerage for life proposition.

- Zerodha has a well-established customer base and advanced trading platforms like Zerodha Kite.

- m.Stock offers a user-friendly platform with advanced trading features and tools.

- Pricing structures vary between the two brokers, with Zerodha offering zero brokerage for equity delivery trades, while m.Stock charges a one-time fee of ₹999 for zero brokerage across all products.

Features and Offerings

Both M Stock and Zerodha offer a wide range of features and services that cater to the needs of different types of traders. Zerodha, being the largest stock broker in India, provides access to stocks, derivatives trading, and direct mutual fund investments. It boasts a customer base of over 12 lakh traders, which is a testament to its popularity and reliability.

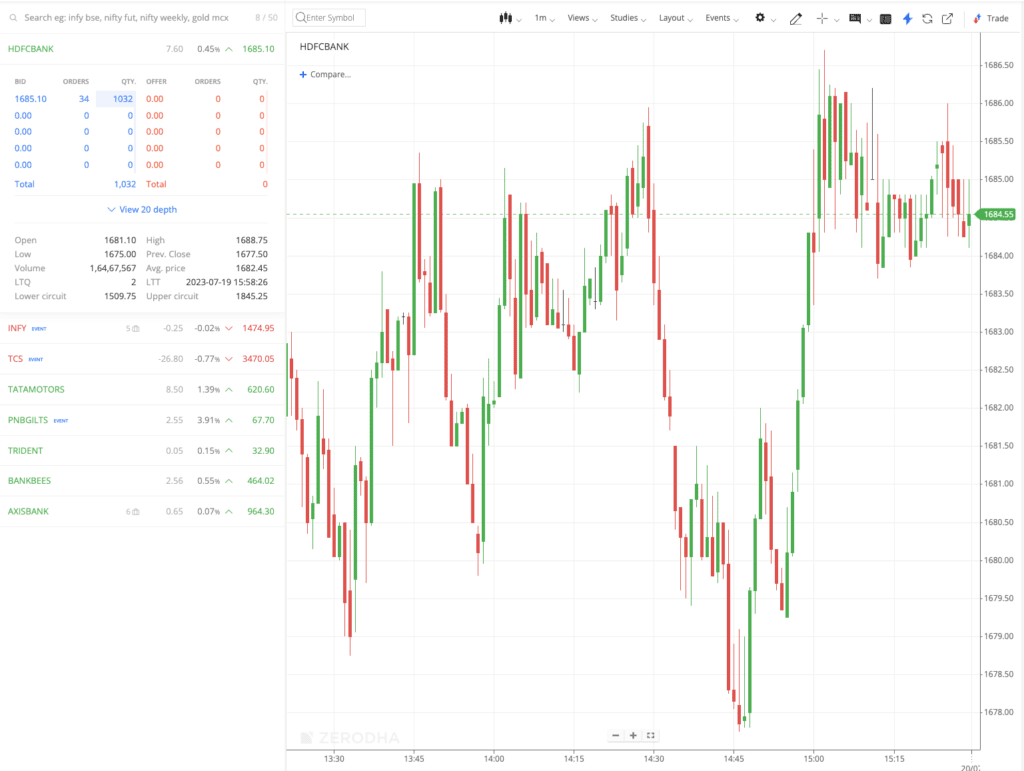

One of the standout features of Zerodha is its intuitive trading app, Zerodha Kite. This platform offers a user-friendly interface and a host of advanced features and tools that make trading seamless and efficient. It allows traders to analyze market trends, place orders, track portfolios, and execute trades effortlessly.

On the other hand, m.Stock, launched in April 2022 by Mirae Asset, is a relatively new player in the Indian broking space. However, it has quickly gained attention with its unique offering – zero brokerage for life. Traders can avail of this proposition across all products by paying a one-time fee of ₹999. m.Stock also provides an option to waive off demat charges for life, further adding value to its customers.

Zerodha offers a comprehensive suite of features and services, backed by its well-established customer base and advanced trading platform. On the other hand, m.Stock’s zero brokerage for life proposition and user-friendly platform make it an attractive option for traders looking for cost-effective trading solutions.

Ultimately, the choice between M Stock and Zerodha will depend on individual trading preferences and requirements. Traders should carefully consider the features, offerings, and pricing structures of both brokers to make an informed decision. Whether you prioritize a large customer base and advanced trading tools or seek a cost-effective solution with unique offerings, both M Stock and Zerodha have something to offer. Take the time to evaluate your needs and choose the broker that aligns best with your trading goals.

| Brokers | Features | Offerings |

|---|---|---|

| Zerodha | Zerodha Kite trading app | Access to stocks, derivatives trading, direct mutual fund investments |

| m.Stock | User-friendly platform with advanced features and tools | Zero brokerage for life, one-time fee of ₹999, option to waive off demat charges for life |

M Stock vs Zerodha Trading Platforms

The trading platforms offered by M Stock and Zerodha play a crucial role in the overall trading experience, making it important to evaluate their user interfaces, functionalities, and available tools. Zerodha, being the largest stock broker in India, offers a robust and feature-rich trading platform called Zerodha Kite. With its intuitive design and user-friendly interface, Kite provides traders with a seamless trading experience. It offers a wide range of advanced features and tools, including real-time market data, customizable charts, and a comprehensive set of technical analysis indicators. Traders can access and manage their portfolio, execute trades, and monitor market movements all in one place.

On the other hand, m.Stock, being a new entrant in the Indian broking space, offers a user-friendly platform with advanced trading features and tools. While it may not have the same level of sophistication as Zerodha Kite, m.Stock platform caters to the needs of both beginners and experienced traders. It provides a simple and intuitive user interface that allows traders to execute trades efficiently. The platform also offers various tools such as watchlists, advanced order types, and real-time market updates to assist traders in making informed investment decisions.

Both brokers strive to provide a seamless trading experience, but the choice between the two ultimately depends on individual preferences and requirements. Traders must consider factors such as ease of use, available features, and customization options when evaluating the trading platforms offered by M Stock and Zerodha. To help you make an informed decision, below is a comparison table summarizing the key features and functionalities of Zerodha Kite and m.Stock trading platforms:

| Features | Zerodha Kite | m.Stock |

|---|---|---|

| User Interface | Intuitive and user-friendly | Simple and user-friendly |

| Advanced Features | Real-time market data, customizable charts, technical analysis indicators | Watchlists, advanced order types, real-time market updates |

| Accessibility | Available on web, mobile (Android and iOS), and desktop | Available on web and mobile (Android and iOS) |

| Customization | Offers extensive customization options | Offers basic customization options |

It is advisable to test both platforms and explore their features using the demo versions or trial accounts to determine which one aligns better with your trading style and requirements. Remember, the trading platform is a key tool for executing successful trades, so it’s essential to choose one that meets your needs and provides a seamless trading experience.

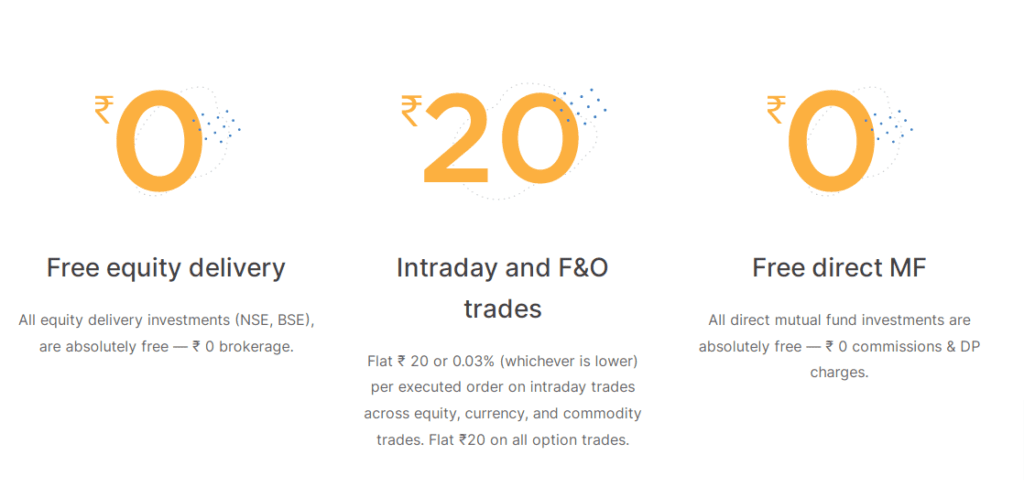

M Stock vs Zerodha Fees and Pricing Structures

Understanding the fees and pricing structures of M Stock and Zerodha is essential in determining the overall cost-effectiveness of trading with these brokers. Both brokers offer competitive pricing models, but there are differences in the way they charge for their services.

Zerodha, being the largest stock broker in India, offers zero brokerage charges for equity delivery trades. This means that investors can buy stocks for delivery without incurring any brokerage charges. Zerodha charges a flat fee of ₹20 per order for intraday and derivative trades, regardless of the trade size. This flat fee pricing model can be particularly attractive for frequent traders who execute multiple daily trades.

On the other hand, m.Stock takes a unique approach to pricing by offering zero brokerage for life across all its products for a one-time fee of ₹999. This proposition can benefit long-term investors and traders who plan to participate in various market segments actively. Additionally, m.Stock provides an option to waive off demat charges for life, further reducing the overall cost of trading and investing.

It is important to note that while Zerodha’s pricing structure may appeal to traders who execute a high volume of intraday and derivative trades, m.Stock’s one-time fee for zero brokerage across all products can be advantageous for investors who hold stocks for the long term or trade across multiple market segments. Ultimately, the choice between M Stock and Zerodha depends on individual trading preferences and the investor’s specific needs.

| Broker | Equity Delivery | Intraday and Derivative Trades | Additional Charges |

|---|---|---|---|

| Zerodha | Zero brokerage | ₹20 per order | Demat charges applicable |

| m.Stock | Zero brokerage for life | Zero brokerage for life | Option to waive off demat charges |

Conclusion

After considering the features, trading platforms, fees, and other factors, it becomes clear that both M Stock and Zerodha have their own strengths and weaknesses, and the choice between them ultimately depends on the individual trader’s requirements and priorities.

Zerodha, being the largest stock broker in India, offers a wide range of features and services. With access to stocks, derivatives trading, and direct mutual fund investments, Zerodha provides a comprehensive platform for traders. Their intuitive trading apps, particularly Zerodha Kite, offer advanced functionalities and user-friendly interfaces.

On the other hand, m.Stock, being a new entrant in the Indian broking space, aims to disrupt the market with its zero brokerage for life proposition. For a one-time fee of ₹999, traders can enjoy zero brokerage across all products. m.Stock also offers the option to waive off demat charges for life, making it an attractive choice for cost-conscious traders.

While Zerodha has an established customer base and advanced trading platforms, m.Stock offers a user-friendly platform with advanced features and tools. Traders should consider their specific trading needs and preferences before making a decision. Whether it’s cost-effectiveness, a wide range of features, or ease of use, both brokers have their own advantages.

Ultimately, traders should carefully evaluate their priorities, weigh the pros and cons of each broker, and choose the one that aligns with their individual requirements. Whether you prioritize competitive pricing, advanced trading tools, or a zero brokerage for life proposition, both M Stock and Zerodha have something unique to offer. Make an informed decision based on your needs, and start your trading journey with the broker that suits you best.

FAQ M Stock vs Zerodha

What is Zerodha?

Zerodha is the largest stock broker in India with over 12 lakh traders. It offers access to stocks, derivatives trading, direct mutual fund investments, and intuitive trading apps.

What is m.Stock?

m.Stock is a new entrant in the Indian broking space, launched by Mirae Asset in April 2022. It offers zero brokerage for life across all products for a one-time fee of ₹999.

What are the pricing structures of Zerodha?

Zerodha has zero brokerage for equity delivery trades and a flat fee of ₹20 per order for intraday and derivative trades.

What are the pricing structures of m.Stock?

m.Stock offers zero brokerage for life across all products for a one-time fee of ₹999. It also provides an option to waive off demat charges for life.

What are the trading platforms offered by Zerodha?

Zerodha offers advanced trading platforms like Zerodha Kite.

What are the trading platforms offered by m.Stock?

m.Stock offers a user-friendly platform with advanced trading features and tools.

What are the fees associated with trading on Zerodha?

Zerodha charges brokerage fees, account opening fees, and other relevant costs. It has zero brokerage for equity delivery trades.

What are the fees associated with trading on m.Stock?

m.Stock has a one-time fee of ₹999 for zero brokerage across all products. It also provides an option to waive off demat charges for life.