M Stock vs Dhan: Which Demat Is Best For You?

M Stock vs Dhan are two prominent brokerage firms in India, and this article will delve into a comparative analysis of their performance, costs, and reliability. Both firms offer discount brokerage services and cater to the needs of traders and investors across the country. This analysis aims to provide Indian investors with a comprehensive understanding of the strengths and weaknesses of these brokers, helping them make informed decisions for their financial goals.

Key Takeaways:

- M Stock and Dhan are leading discount brokerage firms in India.

- Both brokers offer zero brokerage on certain segments, making them cost-effective choices.

- M Stock provides a range of trading platforms, while Dhan offers multiple platforms including Dhan One, Dhan Web, and a mobile trading app.

- Investment products available through M Stock and Dhan include equity, mutual funds, commodities, and currency investments.

- Customer service, trading platforms, and educational resources should be considered when choosing a broker.

By exploring the comparative analysis of M Stock and Dhan in the following sections, investors will gain valuable insights into the performance, costs, and reliability of these brokerage firms. It is important to assess factors such as account opening processes, brokerage and fees, trading platforms, investment products, tools and analysis options, and customer service before making a decision. The information provided in this article will assist Indian investors in selecting the most suitable broker for their individual needs and preferences.

Overview of M Stock and Dhan

M Stock and Dhan are discount brokerage firms operating in India, each with its own unique offerings and advantages. M Stock, headquartered in Mumbai, India, provides a wide range of investment options and trading platforms. They offer zero brokerage for all segments, making it an attractive choice for traders and investors. M Stock specializes in equity, mutual fund, commodities, and currency investments, catering to the diverse needs of its clients.

Dhan, on the other hand, is based in Bangalore, India, and focuses on providing cost-effective brokerage services. They offer zero brokerage on equity delivery and direct mutual funds. Dhan also provides equity, futures, and options trading, giving investors the opportunity to diversify their portfolio. With multiple trading platforms, such as Dhan One, Dhan Web, and a mobile trading app, Dhan ensures accessibility and convenience for their clients.

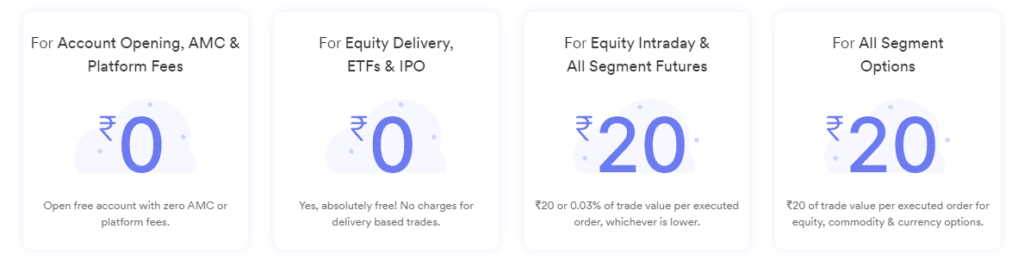

Brokerage and Fees

Both M Stock and Dhan offer cost-effective brokerage services, attracting investors with their transparent fee structures. M Stock provides zero brokerage for all segments, ensuring that traders can make the most of their investments. Similarly, Dhan offers zero brokerage on equity delivery and direct mutual funds, allowing investors to save on trading costs. By keeping their fees low and charges transparent, both brokerage firms prioritize the financial well-being of their clients.

| Brokerage Firm | Account Opening charges | AMC | Brokerage and Fees |

|---|---|---|---|

| M Stock | Rs 999 | Free | Zero brokerage for all segments |

| Dhan | Free | Free | Zero brokerage on equity delivery and direct mutual funds but they charge Rs. 20 per order for Intraday and F&O |

As discount brokerage firms, M Stock and Dhan offer competitive pricing and attractive features to cater to the needs of Indian investors. When choosing between the two, it is important to consider factors such as customer service, trading platforms, and educational resources. By assessing these aspects, investors can make an informed decision that aligns with their investment goals and preferences.

Account Opening Process

Opening an account with either M Stock or Dhan is a straightforward process, but it is important to understand the steps and requirements involved. Both brokerage firms offer online account opening, making it convenient for investors to get started.

To open an account with M Stock, you need to visit their m.stock website and click on the “Open an Account” button. You will then be directed to a form where you need to provide your personal details such as name, address, contact number, and PAN card information. Once you have filled in the form, you will need to upload relevant documents such as your PAN card, Aadhaar card, and bank account details for verification. After submitting the form and documents, your account will be opened within a few working days.

Similarly, opening an account with Dhan is a simple process. You can visit their Dhan website and click on the “Open an Account” option. Fill in your personal details, upload the necessary documents, and complete the e-KYC process. Dhan offers both online and offline modes for account opening, giving investors flexibility in choosing the method that suits them best.

Documents Required

While the account opening process may seem simple, it is important to have the necessary documents in place. For both M Stock and Dhan, you will need the following:

- PAN card

- Aadhaar card

- Address proof (such as a utility bill or bank statement)

- Bank account details (for linking your trading account)

It is advisable to have these documents ready before starting the account opening process, as it will help streamline the process and ensure a smooth experience. Once your account is opened, you will have access to the various investment products and trading platforms offered by M Stock and Dhan, empowering you to make informed investment decisions.

| Brokerage Firm | Account Opening Process | Documents Required |

|---|---|---|

| M Stock | Visit their website and fill in the online form. Upload the necessary documents for verification. | PAN card, Aadhaar card, address proof, bank account details |

| Dhan | Visit their website or choose the offline method. Fill in the form, complete the e-KYC process, and submit the required documents. | PAN card, Aadhaar card, address proof, bank account details |

Brokerage and Fees

When it comes to brokerage and fees, both M Stock and Dhan offer attractive options for investors with their competitive pricing structures. M Stock, a discount broker based in Mumbai, India, provides a zero brokerage facility for all segments. This means that investors can trade in equity, mutual funds, commodities, and currency investments without incurring any brokerage charges. This cost-effective approach makes M Stock an appealing choice for traders and investors looking to minimize their expenses.

Dhan, on the other hand, is a discount broker based in Bangalore, India, that offers zero brokerage on equity delivery and direct mutual funds. Similar to M Stock, Dhan provides a transparent fee structure, allowing investors to maximize their returns. Additionally, Dhan offers equity, futures, and options trading, providing investors with a wide range of investment opportunities.

| Broker | Brokerage | Equity Delivery | Equity Intraday | Futures | Options |

|---|---|---|---|---|---|

| M Stock | Zero | Zero | Rs. 20 per order | Rs. 20 per order | Rs. 20 per order |

| Dhan | Zero | Zero | Zero | Zero | Zero |

Both M Stock and Dhan offer competitive rates for investors, making them popular choices in the Indian market. It is important for investors to carefully consider their trading needs and preferences when choosing between the two. Factors such as customer service, trading platforms, and educational resources should also be taken into account to ensure a well-rounded investment experience.

M Stock vs Dhan Trading Platforms

M Stock and Dhan provide traders and investors with a range of user-friendly trading platforms to execute trades efficiently. These platforms offer advanced features, intuitive interfaces, and seamless access to market data, enabling users to make informed decisions.

M Stock Trading Platforms

M Stock offers multiple trading platforms to cater to different trading styles and preferences. Their flagship platform, M Stock Pro, is a desktop-based application that provides real-time quotes, advanced charting tools, and customizable layouts. Traders can execute trades directly from the platform, monitor their portfolios, and access research reports and market insights.

In addition to M Stock Pro, M Stock also offers a mobile app for on-the-go trading. The app is feature-rich, allowing users to place orders, track their investments, and receive real-time notifications. With its user-friendly interface and robust functionality, the M Stock mobile app is a popular choice among traders.

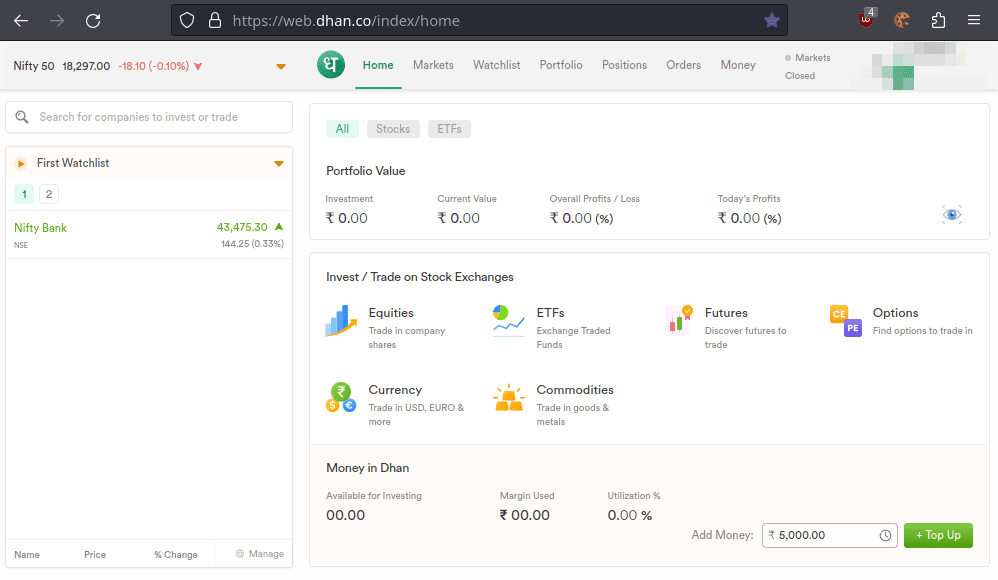

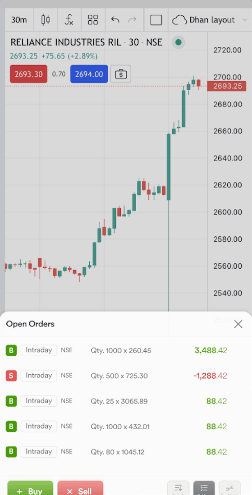

Dhan Trading Platforms

Dhan provides traders with a variety of trading platforms to suit their needs. Their flagship platform, dhan One, is a feature-packed desktop application offering advanced charting tools, customizable layouts, and real-time data. Traders can execute trades across multiple segments, access market depth information, and analyze historical data to identify trading opportunities.

For those who prefer web-based trading, Dhan offers dhan Web, a browser-based platform with a sleek interface and intuitive navigation. Traders can access real-time quotes, place orders, and monitor their portfolios from any device with an internet connection.

Additionally, Dhan has a mobile trading app that allows users to trade on the go. The app provides a seamless trading experience with its user-friendly interface, real-time market data, and advanced order types.

Both M Stock and Dhan prioritize user experience and provide comprehensive trading platforms that cater to the needs of traders and investors. Whether you prefer desktop-based applications, web-based platforms, or mobile apps, both brokers offer a range of options to enhance your trading experience.

| Broker | Trading Platform |

|---|---|

| M Stock | M Stock Mirae |

| Mirae App | |

| Dhan | Dhan Web |

| Dhan App |

M Stock vs Dhan Investment Products

Both M Stock and Dhan offer a diverse range of investment products, catering to the different preferences and strategies of investors. M Stock provides opportunities for investors to trade in equity, mutual funds, commodities, and currency investments. With M Stock, investors can access a wide range of stocks in the Indian market, allowing them to build a diversified portfolio. Additionally, M Stock offers mutual funds, providing investors with the option to invest in professionally managed portfolios across various asset classes. For those interested in commodities and currency investments, M Stock also offers the opportunity to trade in these markets.

Dhan, on the other hand, offers a range of investment products to suit different investment goals. In addition to equity trading, Dhan allows investors to trade in futures and options, providing opportunities for more sophisticated trading strategies. Dhan also offers direct mutual funds, enabling investors to invest in funds without paying any commission fees. This makes it an attractive option for those looking to invest in mutual funds directly. Dhan’s multiple trading platforms, including dhan One, dhan Web, and a mobile trading app, provide investors with flexibility and convenience when it comes to accessing and managing their investment portfolios.

Investment products offered by M Stock and Dhan:

| Brokerage Firm | Investment Products |

|---|---|

| M Stock | EquityMutual FundsCommoditiesCurrency Investments |

| Dhan | EquityFuturesOptionsDirect Mutual Funds |

Both M Stock and Dhan provide a wide range of investment products, allowing investors to choose the options that align with their investment objectives. However, it is important for investors to consider factors such as customer service, trading platforms, and educational resources before selecting a brokerage firm. These additional aspects can contribute to a seamless investing experience and enhance an investor’s overall journey in the stock market.

M Stock vs Dhan Tools and Analysis

M Stock and Dhan equip their clients with a range of tools and analysis resources to assist in analyzing market trends and making informed investment choices. These tools are designed to provide traders and investors with valuable insights and help them stay ahead in the dynamic world of the financial markets.

One of the key tools provided by M Stock is their advanced trading platform, which offers comprehensive charting features, real-time market updates, and customizable watchlists. Traders can access historical data, analyze technical indicators, and implement various strategies to optimize their trading decisions. Additionally, M Stock offers in-depth research reports, market news, and expert commentary to keep clients well-informed and up-to-date.

Dhan, on the other hand, provides its clients with a range of trading platforms, including dhan One, dhan Web, and a mobile trading app. These platforms offer advanced charting tools, live price streaming, and customizable dashboards, enabling traders to monitor market movements and execute trades seamlessly. Dhan also offers detailed market analysis, educational resources, and webinars to empower clients with the knowledge and skills needed to navigate the financial markets successfully.

| Features | M Stock | Dhan |

|---|---|---|

| Advanced Trading Platform | Yes | Yes |

| Real-time Market Updates | Yes | Yes |

| Charting Tools | Yes | Yes |

| Research Reports | Yes | No |

| Education Resources | No | Yes |

Both M Stock and Dhan understand the importance of data-driven decision making in the financial markets. They provide tools and analysis resources that enable their clients to access real-time market data, analyze historical trends, and perform technical analysis. These capabilities empower traders and investors to identify potential opportunities, mitigate risks, and optimize their investment strategies.

It is worth noting that while M Stock offers in-depth research reports, Dhan focuses more on providing educational resources and webinars. This distinction allows clients to choose a broker that aligns with their specific preferences and priorities.

M Stock vs Dhan Customer Service

Reliable customer service is a crucial aspect of a brokerage firm, and both M Stock and Dhan strive to provide responsive and helpful assistance to their clients. M Stock understands the importance of prompt and efficient customer support, offering various channels of communication for investors to reach out for assistance. Their dedicated customer service team is available through phone, email, and live chat, ensuring that clients can have their queries resolved quickly.

Dhan also places a strong emphasis on customer service, recognizing the need for personalized attention and support. They provide a user-friendly interface for investors to access their support services, including a comprehensive knowledge base, FAQs, and a ticketing system for specific queries. Dhan’s customer service team is known for their prompt response time and expertise in addressing investor concerns.

In addition to their respective support teams, both M Stock and Dhan offer educational resources to empower their clients with the knowledge required to make informed investment decisions. These resources include blogs, tutorials, and webinars that cover various investment topics and trading strategies. By equipping investors with educational materials, M Stock and Dhan aim to enhance their customers’ overall trading experience and success.

A Comparison of M Stock and Dhan’s Customer Service

| Brokerage Firm | Customer Service Channels | Response Time | Educational Resources |

|---|---|---|---|

| M Stock | Phone, email, live chat | Prompt | Blogs, tutorials, webinars |

| Dhan | Knowledge base, FAQs, ticketing system | Quick | Blogs, tutorials, webinars |

When choosing between M Stock and Dhan, investors should consider their personal preferences and requirements regarding customer service. Both firms strive to provide excellent support, but the specific channels and resources offered may vary. It is advisable to assess the level of assistance required and explore the available options offered by M Stock and Dhan to make an informed decision that aligns with your trading needs.

Conclusion

After a thorough comparative analysis of M Stock and Dhan, it is evident that both brokerage firms offer competitive advantages, making the choice between them dependent on individual preferences and investment goals.

M Stock, based in Mumbai, is a discount broker that stands out for its zero brokerage across all segments and a diverse range of trading platforms. Investors can enjoy the convenience of trading in equity, mutual funds, commodities, and currency investments through M Stock.

On the other hand, Dhan, headquartered in Bangalore, also offers zero brokerage on equity delivery and direct mutual funds. In addition, they provide equity, futures, and options trading options and have a variety of trading platforms available, including dhan One, dhan Web, and a mobile trading app.

Both M Stock and Dhan boast low fees and transparent charges, making them attractive options for traders and investors. However, before choosing a broker, it is crucial to consider factors such as customer service, trading platforms, and educational resources. These factors can greatly impact an investor’s experience and determine the suitability of a brokerage firm.

FAQ M Stock vs Dhan

What services do M Stock and Dhan offer?

M Stock offers equity, mutual fund, commodities, and currency investments, while Dhan offers equity, futures, and options trading, as well as direct mutual funds.

Do M Stock and Dhan charge brokerage fees?

M Stock offers zero brokerage for all segments, while Dhan offers zero brokerage on equity delivery and direct mutual funds.

What trading platforms do M Stock and Dhan provide?

M Stock offers a range of trading platforms, while Dhan provides dhan One, dhan Web, and a mobile trading app.

Can I open an account with M Stock and Dhan?

Yes, both M Stock and Dhan offer account opening processes.

What investment products can I access through M Stock and Dhan?

M Stock offers equity, mutual fund, commodities, and currency investments. Dhan offers equity, futures, and options trading.

What tools and analysis options are available with M Stock and Dhan?

Both M Stock and Dhan provide tools and analysis options to assist investors in making informed decisions.

How is the customer service at M Stock and Dhan?

The quality of customer service at M Stock and Dhan is an important consideration and should be evaluated before choosing a broker.