M Stock Brokerage Charges

Confused about M Stock Brokerage Charges? Get clarity on the fees and charges, empowering your investment journey in India’s thriving stock market with M Stock.

Key Takeaways:

- M Stock offers zero brokerage charges for life across various trading products

- Customers can save on brokerage fees with the zero brokerage plan

- Additional options are available for account maintenance charges (AMC)

- Other charges and fees include DP charges, payment gateway charges, STT/CTT, transaction charges, GST, SEBI charges, and stamp charges

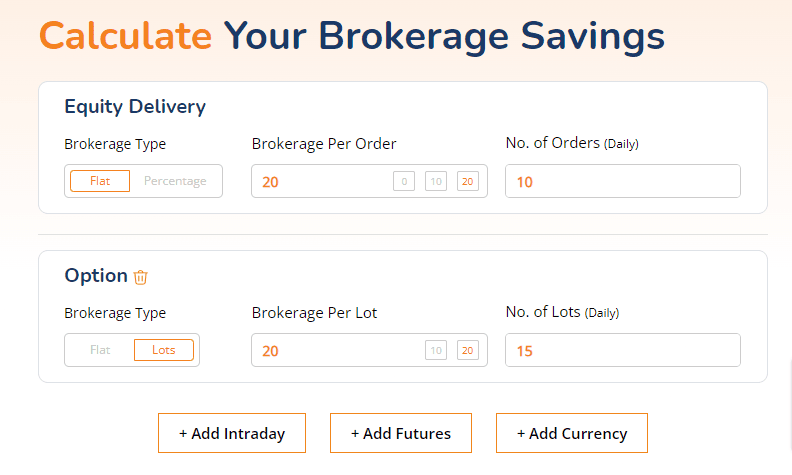

- M Stock provides a brokerage calculator to estimate brokerage savings

Zero Brokerage Charges for Life

Enjoy a lifetime of zero brokerage charges with m.Stock, covering a wide range of trading products including delivery, intraday, futures, ETFs, mutual funds, IPOs, and currency trades. Whether you’re a seasoned investor or just starting your journey in the stock market, M Stock offers a unique brokerage plan that can save you significant fees over time.

With zero brokerage charges for life, you can make trades without worrying about hefty commissions eating into your profits. This offering by M Stock makes it an attractive choice for investors who are looking to maximize their returns. By eliminating brokerage charges, more of your capital can be invested, allowing for potential growth and higher earnings in the long run.

Choose the Best Option for You

When it comes to account maintenance charges (AMC), M Stock provides flexibility with two options. You can choose to pay an additional fee of ₹999 for free lifetime AMC, ensuring that you won’t have to worry about any annual maintenance charges. Alternatively, you can opt for quarterly AMC charges of ₹149, providing you with the freedom to decide how frequently you want to pay these fees.

By offering these choices, M Stock recognizes that every investor has different needs and preferences. Whether you prefer a one-time payment for hassle-free maintenance or prefer the convenience of quarterly payments, M Stock has you covered.

| Trade Type | Charges |

|---|---|

| Delivery | Zero Brokerage |

| Intraday | Zero Brokerage |

| Futures | Zero Brokerage |

| ETFs | Zero Brokerage |

| Mutual Funds | Zero Brokerage |

| IPOs | Zero Brokerage |

| Currency Trades | Zero Brokerage |

When considering your investment options, it’s important to understand the charges associated with different trades. M Stock not only offers zero brokerage charges but also provides transparency with other fees involved, such as DP charges, payment gateway charges, STT/CTT, transaction charges, GST, SEBI charges, and stamp charges, all of which are based on the type of trade conducted.

To help you estimate the potential brokerage savings, M Stock offers a brokerage calculator. This tool allows you to input your trade details and get an estimate of the brokerage charges you can save compared to other brokerage platforms. This feature empowers you to make informed investment decisions based on your trading style and preferences.

Customers who have already chosen M Stock have shared positive testimonials regarding the zero brokerage plan and the ease of opening an account. However, it’s worth noting that some users have experienced issues with app performance and delays in customer support. While the platform offers a competitive brokerage plan, it’s important to consider these potential drawbacks alongside the benefits.

Additional AMC Options

Customize your account maintenance charges (AMC) according to your preferences with M Stock, offering the choice of free lifetime AMC for an additional fee or quarterly AMC charges at a nominal cost of ₹149. This flexibility ensures that you can choose the most suitable option based on your trading needs and frequency.

If you prefer a worry-free experience with no recurring charges, you can opt for the free lifetime AMC by paying an additional fee of ₹999. This means that you won’t have to worry about quarterly charges or renewing your AMC periodically. It’s a convenient option for those looking for a hassle-free investment journey with M Stock.

On the other hand, if you prefer paying AMC charges at regular intervals, you can choose the quarterly AMC option at a nominal cost of ₹149. This allows you to have flexibility in managing your trading expenses and is suitable for those who prefer to pay smaller, regular fees as they trade.

Comparison of AMC Options

| AMC Options | Additional Charges | Benefits |

|---|---|---|

| Free Lifetime AMC | ₹999 | No recurring AMC charges |

| Quarterly AMC | ₹149 | Flexibility in managing expenses |

By providing these options, M Stock ensures that you have control over your account maintenance charges and can tailor them to your specific requirements. Whether you prefer the convenience of a one-time fee for a lifetime of zero AMC charges or the flexibility of quarterly payments, M Stock has you covered. This allows you to focus on your investments and trading strategies without worrying about excessive costs. Start trading with M Stock today and take advantage of their competitive brokerage plan and customizable AMC options.

Other Charges and Fees

In addition to brokerage charges, M Stock also applies other charges and fees such as DP charges, payment gateway charges, STT/CTT, transaction charges, GST, SEBI charges, and stamp charges, varying based on the type of trade. These charges are important to consider as they can impact the overall cost of trading on the platform.

Here is a breakdown of the different charges and fees:

| Charge/Fee | Description |

|---|---|

| DP Charges | These charges are levied by the depository participant and vary based on the quantity of shares held. |

| Payment Gateway Charges | These charges are applicable when making transactions or funding your trading account through online payment gateways. |

| STT/CTT | Securities Transaction Tax (STT) is imposed on equity trades, while Commodities Transaction Tax (CTT) is applicable on commodity futures trades. |

| Transaction Charges | These charges are levied by the stock exchanges on every trade and vary based on the traded value. |

| GST | Goods and Services Tax (GST) is applicable on brokerage charges, transaction charges, and other applicable charges. |

| SEBI Charges | The Securities and Exchange Board of India (SEBI) levies charges for regulating the securities market. |

| Stamp Charges | These charges are applicable on documents such as agreements, contracts, and transfer deeds. |

It is recommended that traders carefully review these charges and fees to have a clear understanding of the costs involved in their trades. This will enable informed decision-making and help optimize trading strategies to maximize returns.

M Stock Brokerage Calculator and Testimonials

Empower yourself with the brokerage calculator offered by M Stock, allowing you to estimate the potential savings on brokerage charges. With this powerful tool, you can input your trading details and get an instant breakdown of the brokerage charges you would incur. It provides transparency and helps you make informed investment decisions.

But don’t just take our word for it. Our satisfied customers have shared their positive experiences with the zero brokerage plan and hassle-free account opening process. Mr. Rajesh Sharma, a long-time investor, praises M Stock for its innovative offering, stating, “I have been trading with M Stock for years, and their zero brokerage plan has helped me save a significant amount on trading costs. It’s a game-changer for investors like me.”

Another customer, Ms. Priya Gupta, appreciates the simplicity and convenience of opening an account with M Stock. She says, “I was hesitant to switch to a new brokerage platform, but M Stock made the process seamless. Their customer support team guided me every step of the way, and I was up and running in no time.”

| Testimonials | Customer Name | Occupation |

|---|---|---|

| “I have been trading with M Stock for years, and their zero brokerage plan has helped me save a significant amount on trading costs. It’s a game-changer for investors like me.” | Mr. Rajesh Sharma | Investor |

| “I was hesitant to switch to a new brokerage platform, but M Stock made the process seamless. Their customer support team guided me every step of the way, and I was up and running in no time.” | Ms. Priya Gupta | Investor |

While the brokerage calculator and positive testimonials highlight the strengths of M Stock’s offerings, it is important to consider potential drawbacks as well. Some users have reported issues with the app’s performance and delays in customer support. However, M Stock continues to work towards improving these aspects to ensure a seamless trading experience for all customers.

In conclusion, M Stock offers a competitive brokerage plan with zero charges for various trading products. The brokerage calculator empowers investors to estimate potential savings, while customer testimonials affirm the benefits of the zero brokerage plan and easy account opening process. As with any platform, there may be occasional challenges, but M Stock remains committed to delivering a reliable and user-friendly trading experience.

Conclusion

In conclusion, M Stock offers a competitive brokerage plan with zero charges for various trading products, making it an attractive choice for investors in India. While customers appreciate the zero brokerage plan and seamless account opening process, it is important to note that some users have experienced issues with app performance and delays in customer support.

With zero brokerage charges for life across delivery, intraday, futures, ETFs, mutual funds, IPOs, and currency trades, M Stock provides a cost-effective solution for investors looking to maximize their profits. The option to pay an additional fee of ₹999 for free lifetime AMC or ₹149 every quarter as AMC offers flexibility in account maintenance charges.

M Stock also provides a brokerage calculator that helps users estimate the brokerage they can save, ensuring transparent and informed decision-making. Positive customer testimonials further highlight the benefits of the zero brokerage plan and the ease of opening an account with M Stock.

However, it is worth noting that some users have reported issues with the app’s performance and experienced delays in customer support. While these concerns should be considered, the overall brokerage plan and cost-saving opportunities M Stock offers make it a compelling option for investors seeking competitive charges.

FAQ M Stock Brokerage Charges

What brokerage charges does M Stock offer?

M Stock offers zero brokerage charges for life across various trading products, including delivery, intraday, futures, ETFs, mutual funds, IPOs, and currency trades.

Are there any additional charges for account maintenance?

Customers have the option to pay an additional fee of ₹999 for free lifetime account maintenance or choose to pay ₹149 every quarter as account maintenance charges.

What other charges and fees are applicable on the M Stock platform?

In addition to brokerage charges, customers may be subject to DP charges, payment gateway charges, STT/CTT, transaction charges, GST, SEBI charges, and stamp charges, depending on the type of trade.

Is there a brokerage calculator available?

Yes, M Stock provides a brokerage calculator that helps users estimate the brokerage they can save on their trades.

What do customers say about the zero brokerage plan and account opening process?

Customers have provided positive testimonials regarding the zero brokerage plan and the ease of opening an account with M Stock.

Are there any issues with app performance or customer support?

Some users have reported issues with app performance and delays in customer support on the M Stock platform.